How Financial Automation Affects the Transaction Matching Process

Blog post

Share

The expectation of “doing more with less” is not new for the office of finance. Accountants have long been expected to perform the numerous tasks of the close cycle in a timely and accurate manner. However, many financial processes require an excessive amount of work, especially for companies that still leverage manual processes and outdated close tools, like binders and spreadsheets.

Newer technologies, such as automated transaction matching solutions, cut down on the time accountants spend performing close activities. This blog discusses the challenges associated with manual transaction matching and the benefits and ROI automation provides.

Manual Transaction Matching Challenges

One of the base financial processes any company has to perform is transaction matching. However, for companies that have to match a high volume of transactions— whether this is vendor, bank, credit card, or cash reconciliations— this can be an extremely manual, time-consuming process. With traditional tools like spreadsheets or binder methods, this simple process takes weeks of accountants bent over their desks, uploading, locating and reconciling these transactions with a highlighter. For finance leadership, there is no way to know the status of the overall transaction matching activities without meetings, whether these are in-person conferences or virtual calls, which detracts more time from the actual execution of the process.

Not only does this under-utilize your highly trained accountants’ skillset, but it takes away time that could’ve been spent on more strategic, value-adding tasks. It also wears down employee morale due to the large amounts of time they spend completing these simple data-entry activities, increasing the likelihood that they will experience burnout and further slow down processes that are already up against hard deadlines.

Additionally, these outdated approaches generally leave no extra time to effectively drill down into the exceptions. Without figuring out exactly how those discrepancies occurred, finance and accounting teams simply treat the overall symptoms of the underlying process’s problems. More than likely, the same types of inconsistencies will pop up in the next close cycle, because manual processes don’t easily allow finance teams to diagnose and treat process inefficiencies.

Automated Transaction Matching With Adra Matcher

Transitioning the transaction matching process from manual methods to an automated transaction matching tool, like Adra Matcher, will change the daily activities of an organization’s finance and accounting team. First, less accountants will have to concentrate on transaction matching tasks, and they will spend less time ensuring it gets done on time and correctly.

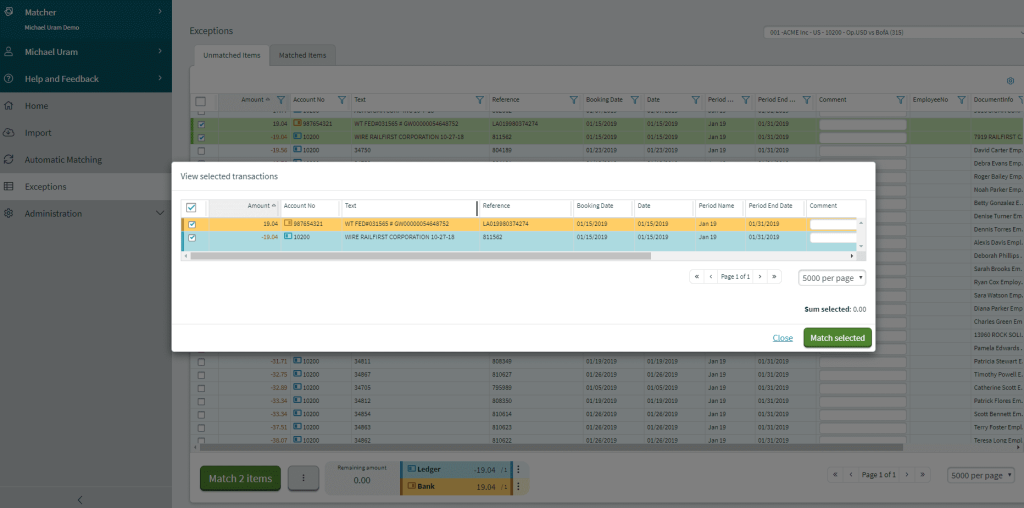

With Adra Matcher, transactions can be automatically matched according to specific rules and procedures that the organization’s office of finance determines. Whenever a discrepancy is found in the transactions, the software flags these and alerts the accountant assigned to the task, like in the screenshot below:

The accountant can then spend their time figuring out the root cause of the exception, instead of combing through and reconciling transactions that match perfectly already. And, instead of having to schedule constant task update meetings, financial management can simply log into Adra Matcher and pull up the dashboard to see the progress of the matching process.

Adra Matcher reduces the time spent matching transactions by 70%, freeing a significant portion of an accountant’s day. Automating the processes within the close cycle, like transaction matching, allows more time to be focused on strategic tasks for the organization, such as formulating strategies to drive new business. Accountants can refocus their high-level skills on high-level activities and they don’t have to work late nights and weekends anymore. This grants more job satisfaction for employees and ensures that more progress can be made for the organization with a motivated and dedicated team.

“Just one account took me about a week and a half, pulling all the reports and reports from the bank and matching them up manually. I now use Matcher. And through that process now —from pulling the files, uploading and all of that — it takes me about two days.” –Ouachita Baptist University

Read the Zenith case study to learn more about Adra Matcher and the benefits your organization can reap from financial close automation, specifically a transaction matching solution.

Written by: Ashton Mathai