Simplifying Cross Legal Entity Reconciliations with Balancer

Blog post

Share

Whether it’s adding locations to a growing business or a multinational merger or acquisition, many companies are expanding their footprint. Due to these types of expansions, accounting departments must now face the challenge of reconciling balances across various entities. The definition of an “entity” varies from company to company, with some using “entity” to refer to different operating locations and others using “entity” to refer to subsidiaries of a parent company.

The latter example is a classic example of a management hierarchy that leads to complicated intercompany accounting. Intercompany accounting refers to the processing and accounting for internal financial activities and events that impact multiple legal entities within a company. One of the most time-consuming and resource-intensive challenges of accounting across multiple entities are reconciliations, or what Adra refers to as cross legal entity reconciliations.

What Is So Challenging About Cross Legal Entity Reconciliations?

Many factors contribute to the complexity of cross legal entity reconciliations. One of the biggest issues is disparate technologies amongst complex legal entities. With many different company subsidiaries, accountants must face the challenge of using various ERPs or subsidiary systems to perform month-end reconciliations. This creates little to no visibility into the reconciliation processes, which can vastly differ from entity to entity. If some of these entities are multinational, differing currencies introduce even greater complexities in reconciling these accounts. These challenges ultimately slow down the financial close process.

How Does Adra’s Balancer Simplify Cross Legal Entity Reconciliations?

Balancer simplifies the challenges above by providing enhanced visibility and control around cross legal entity reconciliations. Instead of housing reconciliations within various ERPs or spreadsheets amongst various legal entities, Balancer allows for a centralized location of all account reconciliations.

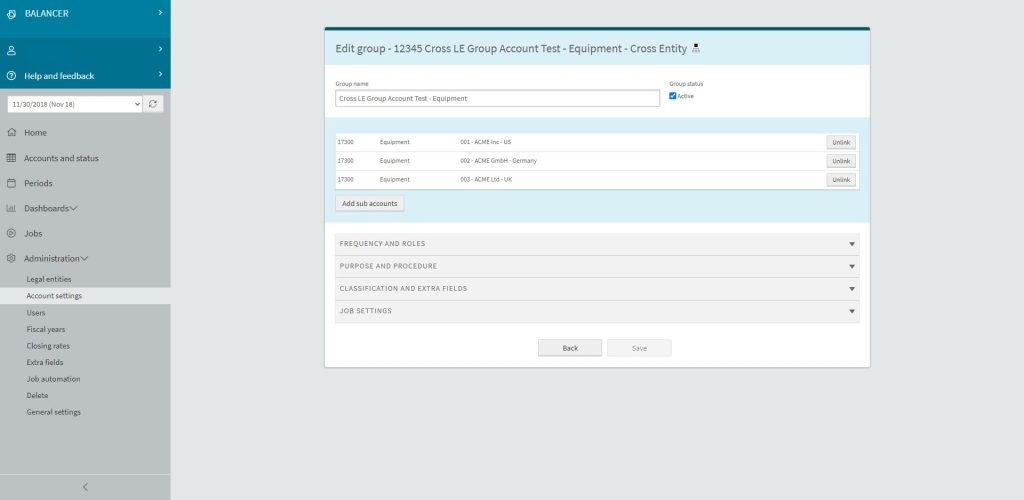

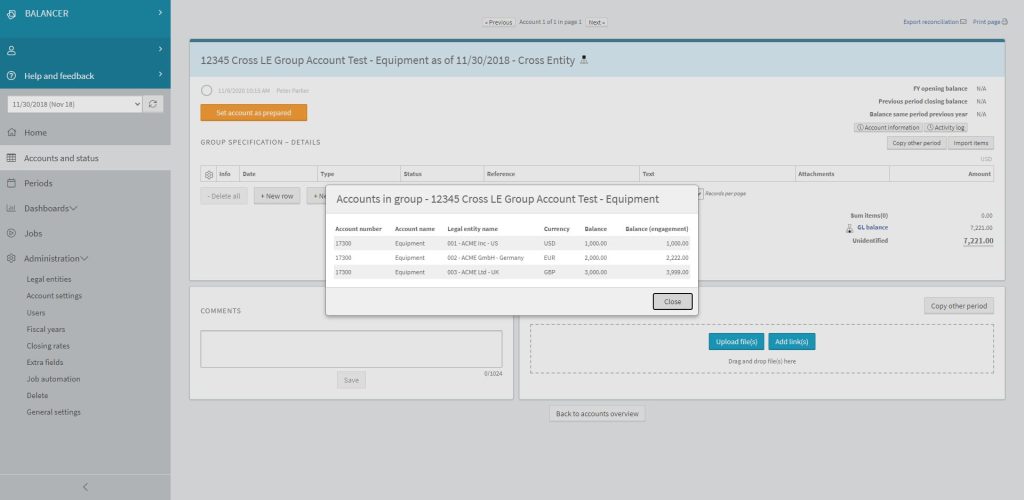

With its new cross entity reconciliation feature, Balancer users can now create account groups across legal entities. This allows for the consolidation of reconciliations that were previously done individually, greatly decreasing the amount of time spent reconciling these accounts.

If the accounts within the account group have a net-zero balance, Balancer automatically certifies the accounts, allowing more time to be allocated to complex reconciliations. The software also allows for account reconciliation of differing currencies. Users can then define exchange rates within Balancer, eliminating the difficulties in foreign currency translation.

Eliminating some of these common challenges with cross legal entity reconciliation allows for greater effectiveness within the financial close. Balancer provides dashboards for users to track the progress of cross legal entity reconciliations, allowing for global visibility into accounting processes.

Case Studies for Balancer’s Newest Cross Legal Entity Reconciliation Feature

Intercompany Case Study

Widget Co. is a large manufacturing company that produces widgets. The company has many different lines of business labeled as subsidiaries to the parent company, Widget Co. Each of these subsidiaries produces a piece of the overall widget that is then sold to the market by Widget Co. Because of this, subsidiaries must purchase products from other subsidiaries, creating intercompany transactions that must be booked by both involved subsidiaries.

When Widget Co. reconciles these accounts, the expectation is that these accounts would net to zero. Unfortunately, this is not typically the case, and Widget Co. must work with its subsidiaries to investigate the differences and book adjusting entries. Because this information lives within the multiple subsidiaries’ accounting subsystems, this process is time-consuming, further slowing down the close process. To eliminate this bottleneck, Widget Co. implemented Balancer, allowing the organization to group these intercompany accounts together to easily identify the differences and adjust accordingly. This ultimately reduced the time to complete the financial close.

Corporate Allocation Case Study

Technical U is an institution of higher education with many different campuses in various locations. Technical U frequently has prepaid expenses that must be allocated to every campus. Each campus is treated as a subsidiary, with Technical U acting as the parent company.

Before Balancer, the various campuses were not aware of what allocation of these prepaid balances they needed to reconcile due to the lack of information around the typically disparate rationale for the allocations. Because of this, Technical U performed the reconciliations for all the campuses at the parent level, a time-consuming process. With Balancer, Technical U can instead consolidate these accounts into one reconciliation, where appropriate documentation can be attached for the prepaid expenses.

Whether your company needs to solve for reconciliation accuracy for corporate allocated prepaid expenses or you struggle with reconciling your intercompany, this new feature will enable you to streamline those period-end reconciliations into a single, manageable reconciliation. Further, you might be able to implement some levels of automation to further streamline the financial close process.

Although many companies are facing the challenge of expanding in a global economy, Adra Balancer further simplifies the complexities of cross entity reconciliations. Accounting teams now have full visibility into the financial close process, allowing for greater control and a reduction in the overall risk.

“When I saw Adra Balancer I understood its unique advantage and how much effort it could save us. We knew our monthly financial reconciliation and closing routines were going to be improved and well defined with the solution.” – Toyota Financial Services Corporation Sweden

Learn more about Adra by joining us for a high-level product demonstration into the Adra Suite.

Written by: Renee Olmos