4 Ways to Modernize Finance Organizations and Operations with Auxis

Blog post

Share

Trintech recently hosted a four-day conference to advance product knowledge, share best practices and insights, and discuss current work experiences. Trintech partners and industry leaders from around the world participated in this virtual event.

Eric Liebross, Senior Managing Director of Business Operations and Transformation at Auxis, and Enrique Martinez, Managing Director of Finance Transformation and Consulting at Auxis, spoke at Trintech Connect to share their insights on modernizing finance. Auxis is a leading outsourcing and management consulting firm that specializes in helping companies optimize their back-office operations.

The term “finance modernization” can mean a myriad of things; whether it’s a simple process transformation or an overhaul of a finance organization’s operations, finance modernization benefits the business through automation and analytics.

Transitioning an organization from primarily operating with manual methods to instead analyzing financial data through the automation of financial processes is not a one-step solution. Modernizing finance organizations is often a journey that usually involves many teams and personnel.

“Finance departments have the opportunity to be at the axis of strategy, analytics, and digital transformation.” –Enrique Martinez, Auxis

1. Stop Being a Transaction Processing Shop

Manual finance processes typically prioritize the use of spreadsheets and binders, meaning accounting teams are spending the majority of the financial close – and their daily tasks – focusing on recording, matching, and balancing transactions and accounts. When accountants dedicate their focus on repetitive tasks and processes, the productivity of the whole accounting team tends to be halted by those manual methods alone.

“Traditional corporate finance operating models are outdated and not well-positioned to deliver on today’s demands,” said Eric Liebross. Liebross also mentions that finance organizations that exclusively utilize spreadsheets to record and report transactions are also “historically-oriented, meaning they look backward at what happened rather than looking forward to what will happen.”

The evolution from traditional to modern finance lies in the collaboration between technology and accounting and how that combination can not only benefit the organization but also the entire business.

“Modern finance is moving the finance organization from a transactionally-heavy, historically-oriented organization to one that is forward-looking and commercially-oriented,” states Liebross.

2. Become an Analytics Powerhouse

Digital technologies aren’t just catered to financial processes; they also can help organizations analyze and learn from accounting data. “The other side benefit is the ability to get more effective in terms of analytics and bring information back to the business,” says Eric Liebross.

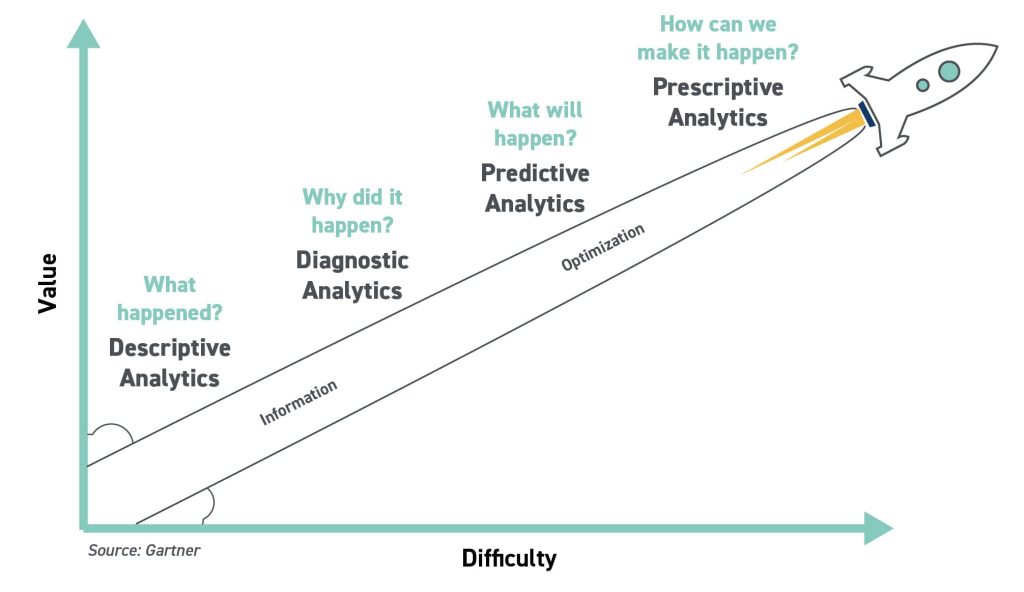

Transitioning from the traditional descriptive and diagnostic analytics to modern predictive and prescriptive analytics allows businesses to remain forward-looking and prepare for the future. Getting real-time insight from analytics and using that information to make major business decisions can propel the organization even further. Shifting the capabilities of analytics away from “what happened” and instead focusing on “what will happen” and “how can we make it happen” prepares finance organizations for the future.

“Analytics is truly the core of the modern finance organization,” says Enrique Martinez.

3. Develop a Commercial Mindset

Modern finance organizations need to not only focus their efforts on accounting functions but also concentrate on the business’s industry. Martinez mentions that organizations must have “not only the accounting principles, expertise, and compliance [handled], but also really [must understand] what’s going on in [their] industry.” Grasping how external factors are impacting the business, such as customer behaviors and latest technologies, provides further visibility and benefits into the organization.

4. Build a Collaborative Ecosystem

Enacting digital change for an organization is not a quick process. In order to be successful, finance organizations must have support from both their colleagues and other departments. Transitioning from manual, traditional finance to modern finance also requires a collaborative effort throughout the entire business organization.

A partnership between finance and IT teams successfully enables the implementation of new technology for all users. Having an ongoing collaboration between multiple departments also ensures that there is continued communication and growing relationships between teams.

Implementing a Digital Shift to Modern Finance

The switch to modern finance can’t only be achieved by using new accounting software. The entire finance organization must also change with it. “In order to make that transition, finance needs to pivot. It needs to become a value-added organization,” states Martinez.

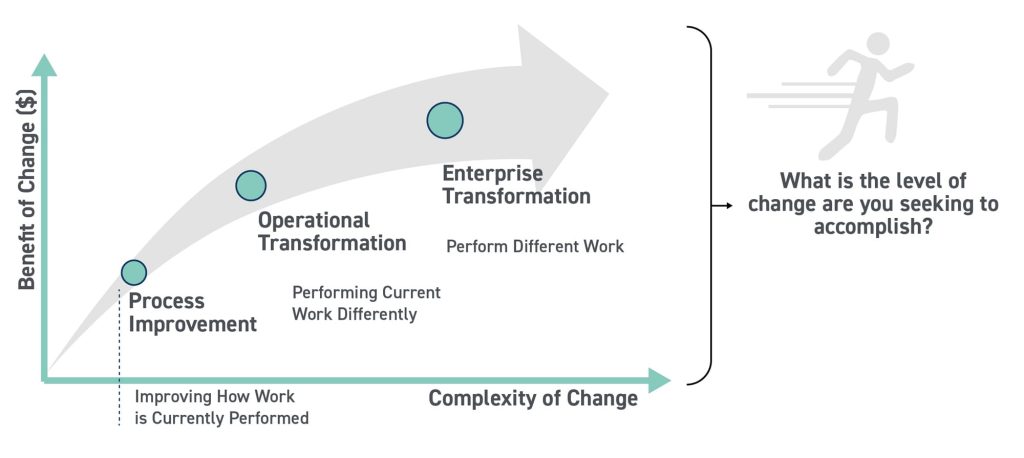

Businesses also must understand that the financial journey is not a “one-size-fits-all” approach. They should also be pragmatic about the shift that must occur internally. “You need to have a realistic expectation on why you’re going on this transformation journey,” adds Martinez. “Before you start talking about technology, take a step back, and think about what you want to achieve at the end of that project.”

Whether organizations want to change their processes or engage in operational transformation, the improvements that are being made should also align with business value drivers. Cost reduction, scalability, and real-time reporting are only a few benefits that organizations can derive from digital technology.

“Digital technology is a tool to help you move from [manual processes] to modern finance. Modern finance requires technology to eliminate a lot of the transactional activity, moving [accountants] from a score-keeper to a true business advisor,” Eric Liebross emphasizes.

To learn more, view this on-demand webinar with The Hackett Group and Trintech, where we discuss the 2020 Key Issues Study in more detail and explore how finance organizations are prioritizing their initiatives to modernize their approach and technology architecture.

Written by: Alex Clem