13 Finance and Accounting KPIs to Prioritize

Blog post

Share

The importance of assessing core accounting metrics has been brought up time and time again, but how do you effectively categorize your key performance indicators so that your F&A teams are set up for success? In the Adra® by Trintech webinar, we discussed the importance of aligning financial close metrics with the overall business strategy to ensure the alignment between the Office of Finance and the organization. In short, rather than focusing on pure organizational metrics, leading organizations must focus on KPIs that support the business’s short-, mid-, and long-term strategies.

It is paramount to ensure your metrics span across the entire close process — ranging from cost, time, effort, to quality. From the outset, when you are looking at managing your metrics, you must look at your financial process holistically. By stepping back and looking at the sum of the parts of your financial close, you will start to move from simply viewing metrics that give you the information that you already know to those that begin to tell you what you really need to know to improve the quality of your financials.

Holistic Close KPIs

Managing your accounting KPIs from a holistic point of view is crucial to ensure the entire financial close process is managed effectively. Leading organizations that leverage technology to drive performance have been proven to complete the financial close quicker — all while reducing the number of resources and amount of money required to complete each month-end close. Some key metrics to track include profit and loss exposure, process costs, time to close, and close quality.

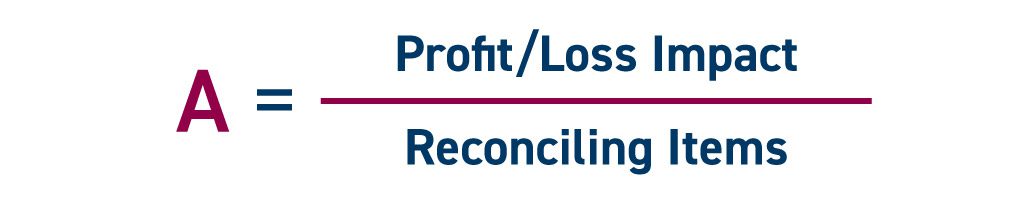

Profit and Loss Exposure

This metric provides organizations an impact on profitability and risk to the business. By dividing the profit and loss impact from the number of reconciling items, businesses can evaluate the effect high-volume reconciliations have on the risk profile and the organization’s profits.

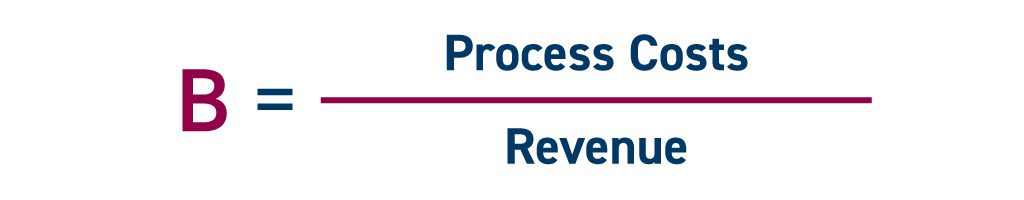

Process Costs

This accounting metric identifies the cost of managing the entire financial close process as a ratio of the total organizational revenue. Leveraging automation technology not only empowers organizations to reduce overall resources and costs but also enables Offices of Finance to effectively scale their operations to accommodate high-volume transactions.

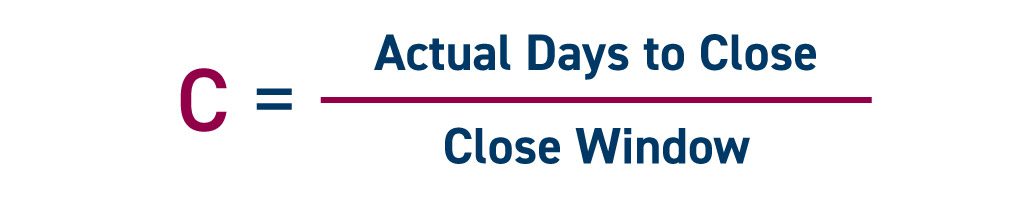

Time to Close

This finance KPI enables organizations to identify how successful they are in meeting their days to close target versus how many days it is truly taking. Evaluating this gives visibility into the financial close timeline and gives insights into what may be preventing F&A team members from completing their tasks on a timely basis.

Close Quality

Evaluating the financial close quality metric relies on the numbers found in the previous three formulas. This formula gives a strong indication of the quality of the entire financial close process, further leading to reduced rework and expenses.

Close Monitoring KPIs

Analyzing close monitoring metrics empowers Offices of Finance and leaders to have more confidence in the consolidated management report that is filed each period.

On-Time Critical Path

This accounting metric oversees the risks associated with the number of critical activities performed in the Office of Finance. If too many critical tasks are not performed on time, there can be an increase in the organization’s financial risk profile.

Comparability

This financial close metric is focused on comparing the number of task types per business unit (BU) to evaluate the distribution and completeness of financial close tasks. Instead of placing the burden of close tasks on a select few people, delegating tasks enables accountants to have a more evenly distributed workload — further reducing the amount of overtime and instances of burnout.

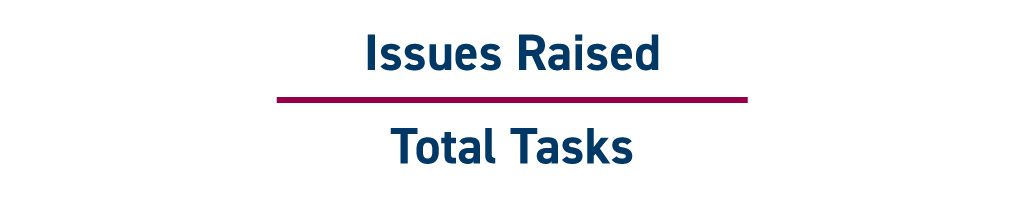

Issue Management

These key finance KPIs measures the effectiveness of the close cycle, specifically around how many issues are being raised against the total number of close tasks. As organizations scale their operations, it is crucial to keep an eye on issues encountered throughout the close — those issues may be a sign that workflow inefficiencies are piling up.

Reconciliation KPIs

Key performance indicators that measure the effectiveness of specific processes are key to evaluating core accounting processes at a granular level. This enables leaders to encounter opportunities to efficiently automate any controls or bottlenecks.

On-Time Reconciliations

Calculating the number of reconciliations completed on time as a ratio to the total number of reconciliations performed gives financial leaders insight into the effectiveness of the overall reconciliation process.

Number of Aging Items

Evaluating the number of tasks and how long they have been assigned gives finance managers insight as to how many tasks are being accurately addressed in a timely manner and how many tasks are being delayed; this also visualizes any symptoms of close challenges and bottlenecks.

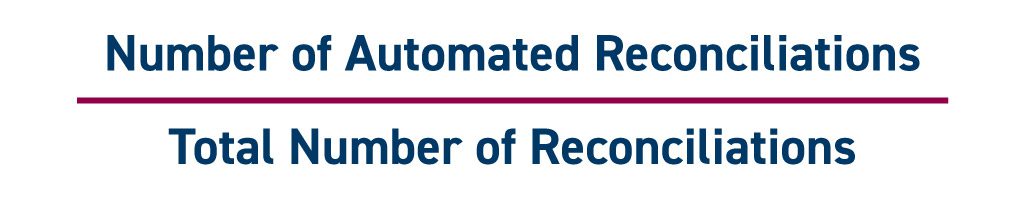

Automated Reconciliations

Similar to the number of reconciliations completed on time versus the total number of reconciliations, this metric on automated reconciliations visualizes the ratio of automated and controlled reconciliations to all reconciliations to identify reconciliation efficiency. The greater number of automated reconciliations are performed, the more efficient that process is.

Compliance KPIs

Last, but certainly not least, are the accounting KPIs specific to compliance. These metrics will evaluate the effectiveness of corporate and regulatory compliance controls across the organization. If an organization’s internal controls are not properly addressed, then these metrics will highlight the need for an effective compliance framework that remediates issues before financial reporting is completed.

Cost of Compliance

This compliance metric evaluates the total costs of compliance on the organization. By adding both the costs of controls and the cost of negative events, organizations can assess their control framework and evaluate where improvements need to be made.

Issue Time to Resolution

Evaluating the issue time to resolution gives finance leaders insight into how quickly each financial close task is being completed. Calculating the days from identification to remediation shows if there are any bottlenecks and lags in the close process.

Test Rate

Lastly, evaluating the control test rate is crucial to determining the efficacy of your controls framework. By dividing the number of control tests by the total number of controls, organizations can evaluate the test rate. This also helps to reduce redundant testing and provide oversight to controls present across business units, locations, and risks.

Evaluating and accurately calculating these thirteen finance and accounting metrics enables Offices of Finance to assess their close processes with clear data. These key performance indicators will also give insight into which areas need improvement over time and which areas of the financial close are already optimized and streamlined.

Over time, finance managers and leaders should evaluate the trend of these key financial close metrics to see how teams are progressing each month. Consistently testing these key metrics enables team members to capture quantitative data for all of their close processes and tasks.

Written by: Alex Clem