Best Practices of Established Shared Service Centers

Blog post

Share

The best practices of shared service centers (SSC) for company’s office of finance have historically been to use the centralization of manual work as a cost-saving measure to help create a standardized and efficient process.

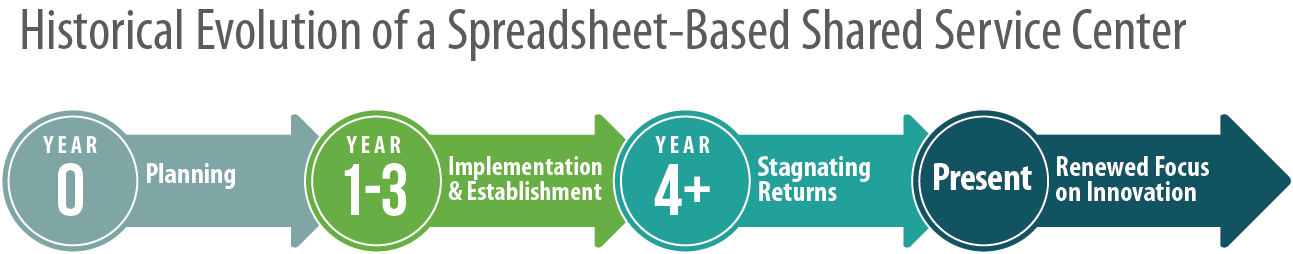

However, as time goes on, the incremental cost savings quickly become stagnant, especially compared to the initial ROI seen at their initial implementation. In response, we’re seeing several forward-thinking SCCs take a step back and look for ways to move away from any and all transactional and administrative work, and towards more knowledge-based work in their Record to Report process.

In fact, a recent survey of more than 600 respondents by the State of the Shared Services and Outsourcing Industry Report shows that this trend does not appear to be slowing down as more companies begin to leverage technology to empower their SSCs.1

While still in the initial stage of this transition, automation of the financial close process has consistently shown the ability to help companies rediscover the same growth that inspired them to move toward an SSC in the first place. Below you’ll find a brief summary of the trends of SSCs that have been established four to six, seven to ten and 10+ years, and a discussion on how some are automating manual tasks and establishing new best practices to mirror the innovation that they were once realizing.

Years 4-6, 7-10, and The Stagnating Returns

The State of the Shared Services and Outsourcing Industry categorizes these two maturity levels as separate entities within their study. However, their trends and adoption percentages of knowledge-based work are almost identical, and unfortunately, these two maturity levels have the second lowest adoption rate across SSCs of all ages. With only about 46% of the companies surveyed saying that knowledge-based work is AT LEAST half of the value that they provide, SSCs within this maturity level appear to be focusing heavily on manual transaction work, as they have historically.

Even though some companies are aware of the new level of efficiency that comes from automating manual tasks, change is scary. It’s easy to feel that there isn’t enough time or resources to make it worth the effort to fix things. Unfortunately, as time goes on, the double-digit cost savings that companies might have seen from the centralization of manual tasks no longer have the impact they once did.

However, there is good news! It appears that the pendulum has begun to swing toward a focus on, and future of, predominately knowledge-based work. The past few years, these maturity levels have slowly but surely begun the process of automating manual tasks to free up the time and effort of their SSC workforce.

While it’s still undergoing what one might consider an infantile state of this transition , there’s a clear focus on moving SSC back into a position where they can provide new-found value like they once did.

10+ Years and The Rediscovered ROI

Once an organization in any industry becomes a seasoned veteran in their processes, even small change can become a very slow process, if it ever happens at all. However, this hasn’t stopped these SSCs from innovating. The SSCs in this maturity level were the original trailblazers that established a centralized process for their manual Record to Report processes and they’re now doing the same with automation and knowledge-based work.

With the second highest level adoption rate of automation and a clear trend from the past couple years of having a heavier focus on knowledge work, it appears that they are continuing to innovate on a best practice that they themselves originally established.

Where to Go Now

For SSCs in the 4-6 and 7-10 year range, it is clear that they’re lagging a bit behind their more experienced counterpart. However, the trends suggest that as they continue to increasingly adopt automation and focus on knowledge-based work they will soon catch up. As the cost savings from an SSC that were once revolutionary become part and parcel of the financial process, SSCs from all maturity levels will continue to move toward financial automation to empower their teams to spend less time on processing the data, and more time gaining insight into the data to make education, actionable decisions.

Written by: Caleb Walter and Ben Cornforth