Maximize Your ERP Investment with Financial Close Software

Blog post

Share

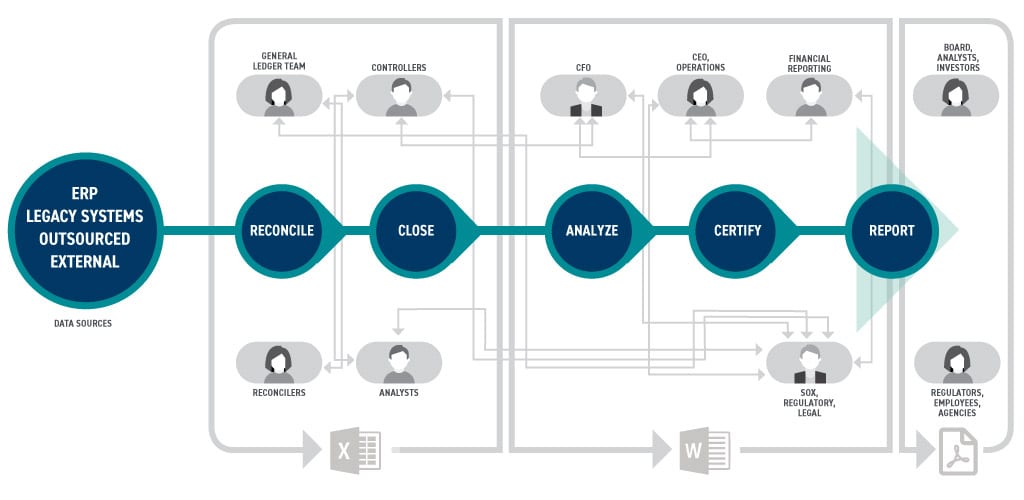

Navigating the financial close is anything but a straightforward process. Multiple key departments and members are involved, documents are being reviewed and approved, while being sent around through email and messages. Factor in multiple ERP and legacy systems, a fully remote or hybrid-working team, and challenges inevitably arise. With so many moving parts, the close can easily become a complex and intertwined web.

Juggling hundreds of documents while manually reconciling statements and invoices leaves organizations vulnerable to risk, errors, and inaccurate reporting. While ERP systems provide a substantial system of record for all organizations, they are not intended to drive the completion of the close.

Challenges Organizations Face from Closing Outside of the ERP

Multiple Different ERPs

Due to mergers, acquisitions, and legacy systems, many organizations have more than one type of ERP system. Using multiple ERP instances while navigating the financial close not only overcomplicates the process but also delays the completion of major deadlines. Add in the challenges that can arise with navigating spreadsheets outside of the ERP systems, and F&A teams may find themselves working excess hours to ensure quality, consistency, and completion of time-sensitive tasks.

Lack of Centralized Solution

Different sections of the business will have different standards leading to inefficiencies, a lack of visibility, poor internal controls, and increased costs. Without a centralized and consistent solution in place, key departments may struggle to meet time-sensitive deadlines. In fact, as many as 62% of respondents indicated that they have trouble meeting critical deadlines when utilizing legacy tools.

Manual Migration of Data

If an organization has a single instance of an ERP system, they inevitably still have to migrate outside of the system to drive the completion of the financial close. While ERP systems house significant operational and financial data, they often lack the capability to automate manual-heavy tasks and optimize the financial close. Not only that, but the majority of close tasks and activities are still occurring outside of the ERP instance. Emails, status meetings, and endless messages are required to keep up to date with the progress of the close.

How an Automated Financial Close Solution Can Help Bridge the Gaps Outside of Your ERP

Relying on manual-heavy processes throughout the financial close leads to a fragmented financial ecosystem. Having a consistent and holistic financial landscape not only streamlines the flow of the close but also heavily reduces risk and errors that may arise in the financials.

Finding an automated solution that seamlessly connects with your ERP landscape is crucial in eliminating manual, repetitive tasks and bridging the gap from the systems of record to the culmination of the close.

Benefits of Financial Automation

In the age of digital acceleration and emerging financial technologies, there is an increased need to automate manual processes. Many organizations are taking the leap to financial automation due to the myriad of benefits it offers their teams and organizations:

- Reduction in workload peaks by spreading the work out more evenly across the entire close period

- Precise repetition of status quo processes

- Ability to customize user preferences within the acceptable parameters of the product

- Improve operational performance and quality

- Reduces overall costs associated with the close

- Decreases overtime and employee burnout

- Increases time for strategic, value-added initiatives

With this many advantages, there’s no question that the shift to automation greatly benefits all members involved.

Next Steps to Optimize Your Financial Close Framework

Before embarking on the journey to automation, it’s crucial to take some time to assess and evaluate what is not working for your organization right now. Sit down with your team and analyze the current systems that exist for your organization.

Identify Which Processes Sit Outside of Your ERP System

Many organizations are looking to automate many portions of their financial close to optimize their workflows and processes. The beauty of financial automation is that eliminating repetitive and manual work can be catered to multiple, if not all, aspects of the close.

Pinpoint the processes that lie outside of your ERP landscape and require excessive, manual work. Financial automation not only bridges the gaps that may exist in your financial close framework but also enables your team to maximize your ERP investment.

Leverage a Financial Close Solution to Drive Positive ROI

Once your organization has prioritized which aspects of the close require automation, leverage a solution that speaks to your needs. Aligning long-term business and technology strategies are instrumental in finding a financial automation vendor that works for your organization. Evaluate the financial close vendor and prepare a prioritization list that addresses the challenges and drive positive return on investment.

Watch this Adra by Trintech webinar to get a firsthand look at how your organization can further drive positive ROI and maximize your ERP investment.

Written by: Alex Clem