Artificial Intelligence: Transforming the Future of the Financial Close

Blog post

Share

Nearly 3 out of 5 global CEOs believe artificial intelligence (AI) will have a larger impact on the world than the internet revolution, with the potential to add $15.7 trillion to global GDP by 2030. This illustrates that organizational leadership recognizes the tremendous value that AI can bring to their functional teams including improved collaboration, productivity gains, deeper engagement, improved user proficiency, and less costly infrastructure. For accounting teams, the greatest day-to-day benefits include time savings and reducing tedious work, allowing them to spend more time focusing on strategic initiatives. This is especially true for accounting teams still bogged down by manual reconciliation and financial close processes that are dependent on spreadsheets or other outdated tools and manual methods.

Your Newest Hire: Artificial Intelligence

Accountants can’t fix every problem with a spreadsheet, especially when those problems involve months or even years of historical financial data. While tasks like account reconciliations and transaction matching are essential, completing them manually is not.

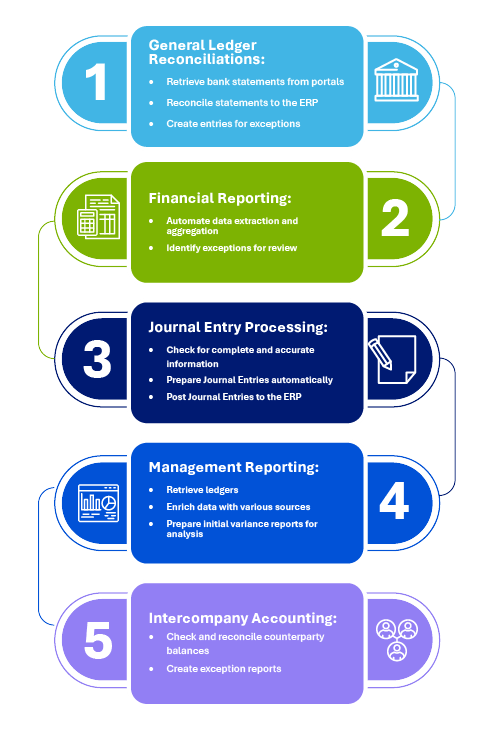

Because reconciliation and financial close processes must adhere to strict codes of conduct and universal rules, they are prime candidates to be completed by artificial intelligence. Here are just a few ways to implement AI into your financial close:

With AI completing the repetitive, rules-based functions of the financial close, accounting teams are free to focus on value-adding tasks that make the accounting profession’s purpose more fulfilling. Instead of simply replacing human workers, AI becomes a “coworker” that assists in getting the job done in the most effective way possible. It completes the essential functions of providing accurate reporting, minimizing risk, and increasing efficiency and effectiveness.

Accounting teams that effectively apply AI to their processes have the opportunity to bring uniquely increased and real value to the larger business, moving from a cost center to a profit generator. What’s needed is an inherent mind shift from backward-looking reporting to forward-thinking analysis and strategy.

This inherent shift in the accounting function means that the necessary skillset is evolving. Understanding programming and statistical analysis, for example, may one day become the norm for accountants. Even if preparing weekly reports based on big data analytics can be automated in a single command code, it will remain essential that the process can be explained, verified, and secure. Accounting teams that invest in upskilling their current employees while training and hiring the next generation of accounting professionals will be most primed for success.

The Bottom Line

Accountants aren’t bean counters; they’re professionals who provide actionable insights to empower the rest of the business. Their professional skepticism is not something that a machine can mimic. By embracing AI, accountants will be even further empowered to provide timely and relevant data to make better business decisions, grow revenue, improve efficiencies, and better manage risk and compliance.