Corporate Finance Automation Trends: Artificial Intelligence and RPA

Blog post

Share

A recent 2020 Forrester Report revealed many insights about the Office of Finance and their financial processes. Prominent findings of the report included current finance automation trends taking place in the market including Robotic Process Automation (RPA) and Artificial Intelligence (AI). Forrester shares that these technologies are crucial for the Office of Finance in the coming year.

Advanced RPA in Finance and Accounting

RPA and automation have become key drivers of value for the Office of Finance. However, finance automation trends are revealing that organizations’ automation needs are evolving from tool-level to broader process-level and involving multiple tools and associated technologies.

Implementing an automated financial close solution that can not only automate tasks but also trigger various close related tasks in other systems is becoming more critical. Advanced RPA within a close solution can allow for these triggers and enable true end-to-end automation. Close solutions like Cadency by Trintech can streamline the financial close process and carve out much-needed time for the Office of Finance.

For example, when it comes to transitioning tasks along the workflow, ERP Bots drive automation of routine tasks within the ERP landscape. They are then able to share status updates with Cadency and activate the next step in the workflow, whether manual or automated. Additionally, ERP Bots can drive deeper automation and ensure steps can be completed without manual effort to ensure accuracy and eliminate the need to write custom code for tasks like tax calculations.

Corporate Finance RPA: The Research Shows…

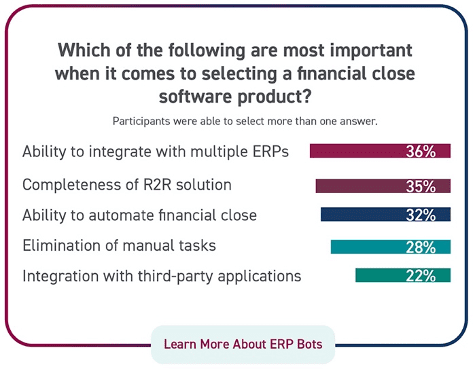

The research from Forrester shows that 32% of organizations identified the ability to automate financial close tasks as one of the most important capabilities of a financial close software solution. Cadency meets this requirement along with other important priorities from this list:

- Ability to integrate with multiple ERPs

- Elimination of manual tasks

- Integration with third-party applications (ex: Trintech/Workiva integration for regulatory reporting)

The need for advanced RPA in finance is becoming increasingly apparent, especially after the impact of COVID-19 on global business and individual organizations.

Configurable Automated Risk Management

Everything the Office of Finance does relies on accurate, timely data that decreases overall risk for the organization. Because of this, finance and accounting teams must take a risk-based approach to every activity and process they manage, especially when it comes to implementing automation. Effectively addressing risk from the very beginning, in the reconciliation process, for example, will allow for significant risk reduction throughout the close process.

Cadency is an automated close solution with risk management automation, with tools built specifically for the Office of Finance like Risk Intelligent RPA (RI RPA), and has proven to be the most effective way to reduce overall risk across the financial close while simultaneously driving efficiencies. Leading organizations that leverage risk-based automation configured according to the specific risk tolerance levels of their internal controls have seen up to a 10% reduction in risk of revenue impact due to misstatement.

Risk Management Automation: The Research Shows…

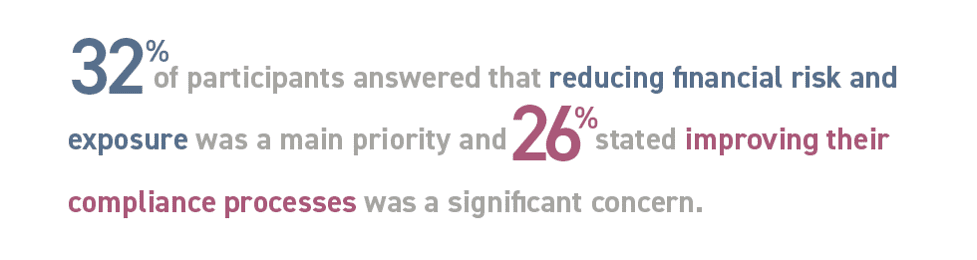

A key finance automation trend the Forrester report examined were organizations’ priorities for the next year. The finance professionals interviewed identified many areas, but some of their biggest concerns were:

The ability to factor in specific organizational risk policies and procedures to the financial close workflow is imperative when it comes to corporate finance automation. Risk should inform everything the Office of Finance does, and their processes need to reflect that. Spreadsheets are inherently full of risk — it’s time for organizations to invest in an automated risk management solution.

Powerful AI Capabilities and Roadmap for the Future

With the advancement of AI, nearly every successful organization is committed to making some level of investment in AI to drive broader efficiencies and reduce overall risk within the R2R process. The Office of Finance is no exception to this commitment.

When it comes to the financial close, AI can be leveraged to identify and quantify risks that are often hidden in the process and give complete peace of mind to the CFO and their team.

AI In Corporate Finance: The Research Shows…

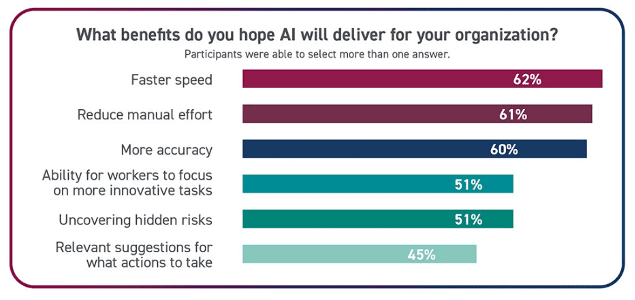

According to Forrester’s research, 80% of respondents said that AI would play a large or central role in their organization’s next wave of financial management technology. Implementing AI into the financial close process is expected to deliver worthwhile benefits for the organization.

Forrester encourages the Office of Finance to push the limits of AI within their core processes. In its most basic state, AI reduces manual efforts, but leading solutions can take AI a step further to apply real learning and intelligence. Organizations that utilize Cadency can leverage AI technology to drive preventative controls to reduce overall risk in the close process. This approach drives efficiencies, while detective controls help to ensure no risky transaction falls through the cracks and goes unnoticed. Partnering with a provider like Trintech who understands this need and is continually working to improve AI functionality designed specifically for the Office of Finance is key.

Learn more about important current finance automation trends and how finance organizations are preparing for the next wave of technology in the Office of Finance.

Written by: Ashton Mathai