Enabling Financial Transformation Through Technology

Blog post

Share

The primary objective of any financial transformation project is to achieve process improvements, improving the quality, effectiveness, and efficiency of financial information which ultimately improves shareholder value. Take the example of the close process.

Best-in-class companies can be seen to close quicker with fewer people. They really can do more with less. So, how can some companies achieve the dream of doing more with less?

The key is to focus on process and technology improvements that remove waste and cost while improving efficiencies.

Finance Transformation Evaluation: Where are you today?

A clear evaluation of where you are today and where you need to drive improvements to meet goals starts with understanding the following:

- Are you using tools in an Ad Hoc fashion?

- Have you achieved better processes and automation but find you are still reactive rather than proactive?

- Do you want to become a world-class organization?

Once you have the answers to the questions above, now is the time to take a deeper dive to understand what other areas are prime for improvement.

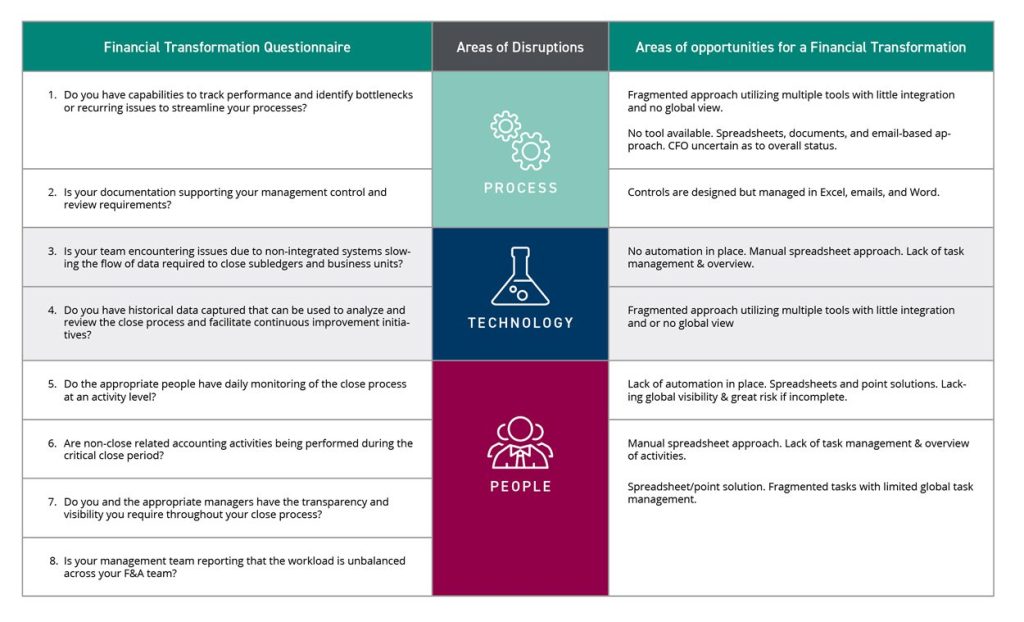

Below are 8 key questions that can assist you in uncovering improvement opportunities within your current financial transformation project and identify the impacted areas (processes, technology, and people) of your financial disruptions.

- Do you have the capabilities to track performance and identify bottlenecks or recurring issues in order to streamline your processes?

- Is your documentation supporting your management control and review requirements?

- Is your team encountering issues due to non-integrated systems slowing the flow of data required to close sub-ledgers and business units?

- Do you have historical data captured that can be used to analyze and review the close process and facilitate continuous improvement initiatives?

- Do you and the appropriate managers have the transparency and visibility you require throughout your close process?

- Do the appropriate people have daily monitoring of the close process at an activity level?

- Is your management team reporting that the workload is unbalanced across your F&A team?

- Are non-close related accounting activities being performed during the critical close period?

In a recent McKinsey study, a lack of automation was rated one of the highest areas for potential company disruption. The study indicates that “manual operations” are a big roadblock for the Office of Finance’s role in the greater digital transformation, even with a healthy financial transformation initiative in progress.

Embedded in the chart below are the areas of opportunities where improvements are needed that affect your processes, technology, and more importantly the people within your finance organization.

Delivering improvements and value during your finance transformation project

Technology with automation is the driving force for delivering improvement within the Office of Finance. Companies that have centralized and standardized systems through automation greatly improve the quality of their data, in this case, numbers, which also increases the integrity. When executed correctly, the goal is to eliminate low-value, menial work to free up your high-value resources to become strategic accountants that can drive the business forward.

To truly achieve your transformation, the Office of Finance must seamlessly extend to the broader organization in a connected, collaborative ecosystem. That ecosystem must not only communicate critical financial data and status across the enterprise, but also gather details that inform R2R activities, adding digitization to what are often inefficient manual communication and tracking methods.

Your finance transformation project: Revolution or Evolution?

Once you have assessed your level of maturity and key areas of focus for improvement, the next big decision is how to implement.

Will you opt for a staged evolutionary approach or a big bang revolutionary one? The answer often comes down to appetite within the organization itself.

The key is to go quickly within your resource constraints. Revolution is the goal but can be a disaster if there isn’t the appropriate support. If there isn’t the money or resources available, look for quick wins and build momentum from there.

Realize that you may not be able to do everything at once. With a large number of processes, people, geographies and partners, start somewhere that is big enough to deliver and demonstrate value but where there will be the least amount of resistance.

Plan thoroughly and improve what has been done before not just replicating existing processes, transformation will only come about through process improvements. Work with a 3rd party or your software vendor to provide best practice.

Ensure that there is a suitable project methodology and defined project team made up of skilled people that have the appropriate resources to make the project a success. Set key milestones and review progress.

And to add, no matter where you are in the transformation process, Trintech has the solution for you.

Written by: Jay Broussard