How Artificial Intelligence Increases the Efficiency and Accuracy Across Your Journal Entry Process

Blog post

Share

There are many organizations today that are struggling in their financial close process, specifically with journal entries, due to the reliance on manual workflows consisting of tools such as emails and spreadsheets with custom-developed macros. If you are one of them, you know the stress and anxiety this creates for your team each period end as they scramble to close on time. It not only creates delays in the process but increases the risk of errors in your JE postings that may require rework or even require restating financial statements. However, it doesn’t have to be this way.

Cadency® by Trintech standardizes your journal entry process with industry-leading features set to manage every aspect of your workflow. It provides flexible configurations to adapt the preparer, reviewer and approver workflow based on your unique needs. Additionally, it provides the ability to validate, post and reverse journal entries in real-time using purpose-built ERP and JE connectors. Based on our internal study, customers have saved more than 40% of time in preparing and reviewing journal entries alone.

Now by most measures, standardizing the Journal Entry process would be considered table stakes in the finance and accounting world, but we are relentless in further improving efficiencies for our customers. With that in mind, we have recently introduced another cutting edge feature as part of our Financial Controls AI™ (FC-AI) offering called AI Risk Rating for Journal Entry.

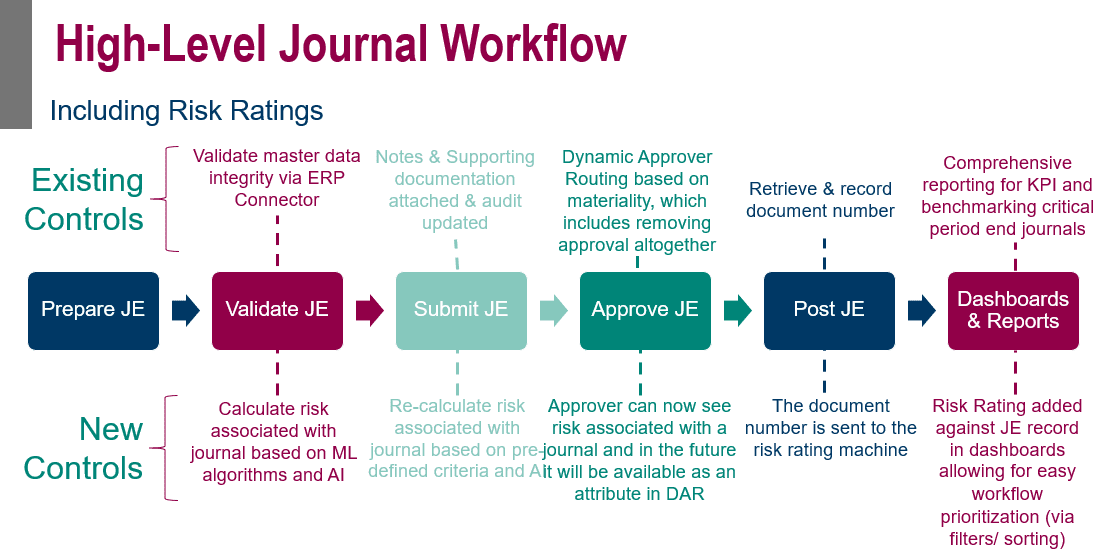

AI Risk Rating for Journal Entry utilizes Trintech’s Financial Controls AI engine called Risk Rating Engine (RRE), which is built to analyze large amounts of financial data based on supervised Machine Learning and allocates risk rating based on the priority configured by the user to various AI control points. The RRE is built to learn from experience with pattern analysis, trend recognition, anomaly detection, and data segmentation.

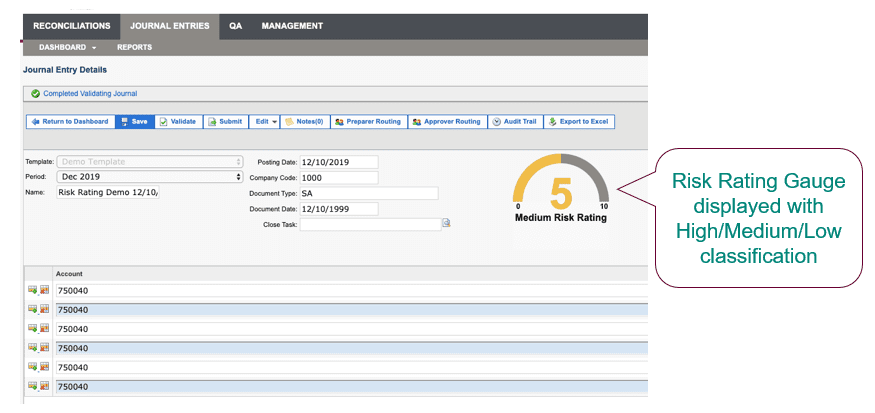

JE preparers, reviewers and approvers are shown the risk rating of the journal and can choose to make any adjustments until they feel comfortable with the risk rating before posting.

Accounting executives and leaders can institute policies and approval workflows to put high-risk journal entries through higher levels of scrutiny to reduce the risk of financial misstatements.

Below is a typical JE workflow with risk rating within Cadency. As you can see, the Risk Rating Engine acts as a virtual aid in every step of the journal entry process.

Our AI Risk Rating for JE is improving our customer’s financial controls and governance in the form of reduced risk, reduced fraud, increased efficiency and effectiveness.

Contact us to learn more about how we can increase the efficiency and accuracy of your journal entry process!

Written by: Mantosh Kumar