How Financial Controls AI from Cadency Improves Your Record to Report Process

Blog post

Share

Historically, the office of finance has lagged behind other business functions when it comes to adopting new technology. For example, while automation beyond spreadsheets macros has just recently become more of a staple in accountants’ lives, this type of technology has already been used by other departments for decades.

However, it appears that the office of finance is going to be one of the first to deploy an emerging technology. Over the past few years, there’s been a growth in Artificial Intelligence (AI) being leveraged by organizations’ finance functions. In fact, according to Gartner, 27% of finance departments expect to deploy Artificial Intelligence as early as the end of 2020. This is a dramatic change from the department that is well known for using spreadsheet technology that was invented in the late 80s’.

This new trend suggests that CFOs and other finance leaders are taking a more aggressive approach when looking for new ways to reduce costs and improve controls. By gathering information, recognizing patterns, and drawing conclusions from those patterns, AI is able to support those initiatives while driving business process improvements, automating manual tasks, and gaining actionable insights from vast amounts of data.

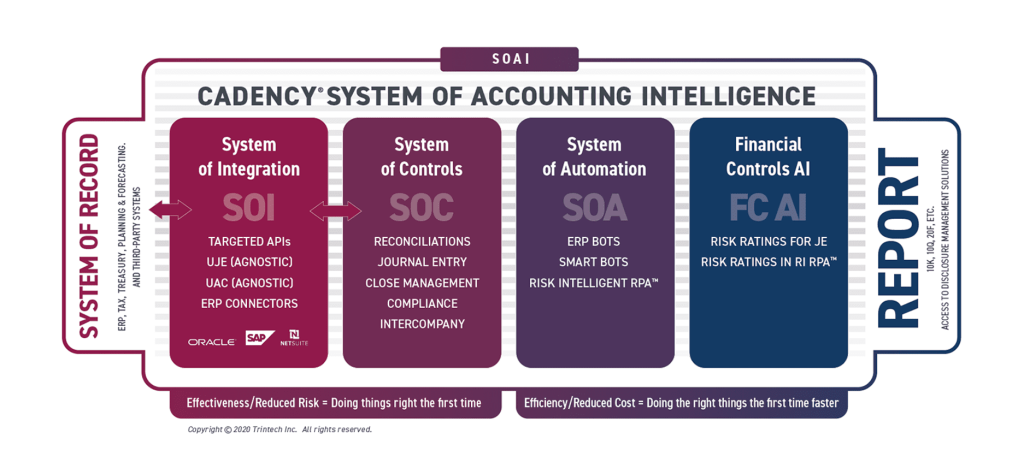

In previous blogs, we talked about the importance of a single System of Record, a defined System of Controls, a System of Integration that enables those two systems to communicate and a System of Automation that increases efficiency and effectiveness based on the rules and risk profiles of an organization. The benefits that these systems can bring to the office of finance are well-established and repeatable, however when AI is implemented into the office of finance, organizations can expand upon the decreased risk and workflow benefits.

Financial Controls AI™ (FC AI) builds upon the benefits of the previous systems by including rules and standards that Trintech has developed over the course of our tenure working with global companies of varying sizes and industries, including the majority of the Fortune 100.

Financial Controls AI (FC AI) asks how we can create action beyond the insight and automation based provided from the previous systems. Additionally, it improves the benefits of the previous systems by quantitatively evaluating risk across various elements of the Record to Report process and automating workflows based on risk profiles, all while identifying financial exposure for human review. FC AI can also analyze your compliance framework and recommend control enhancements using historical and predictive analysis.

Within this blog, we will discuss the final pillar of Cadency’s System of Accounting Intelligence: Financial Controls AI, which is essentially a type of Artificial Intelligence developed specifically for the complex needs of the office of finance.

AI Risk Rating for JE

AI Risk Rating for JE analyzes an organization’s journal entries using machine learning and AI algorithms in order to provide a numerical rating of risk that helps to quickly identify journals that could create risk. This risk is quantified to expose potential material issues that could affect audit risk or financial health. The risk is analyzed in real-time as a user validates or submits a journal, and users are immediately alerted to the risk of the journal as it is created. When it goes to the reviewer to approve, it provides a risk rating to the reviewer so they can determine the level of effort to ‘de-risk’ the entry. If the journal is a 10 out of 10, they can quickly hit approve and move on, but if it is a 6 out of 10 they need to review the journal more closely. This analysis helps improve journal entry governance by mitigating errors, reducing risk and deterring fraud – also saving time and improving efficiency in the reporting process.

“Trintech’s Artificial Intelligence Risk Rating for JE will help HP continue to improve its quality of our JEs, which in turn improves our Balance Sheet and Income Statement. Also, this feature will prevent errors from happening and allow for additional explanation on why the JE was entered to be leveraged by internal and external auditors. We are excited that this functionality will continue to improve the efficiency in our Record to Report process.” –Senior Manager of General Accounting Design, Process & Systems at HP, Inc.

System of Accounting Intelligence

Cadency’s System of Accounting Intelligence combines ground-breaking automation technologies, such as Artificial Intelligence (AI), Robotic Process Automation (RPA) and Bots, and applies them throughout Cadency’s System of Controls (SOC) to support the often complex and complicated Record to Report process. These technologies offer unique, powerful solutions to some of the most complex R2R challenges and readily scale as the financial transformation journey evolves and businesses grow.

To learn more about how the Cadency System of Accounting Intelligence can benefit your organization, check out our webinar.

Written by: Caleb Walter