How to Future Proof Your Financial Processes with the Cadency® System of Accounting Intelligence

Blog post

Share

Over the past few years, offices of finance have increasingly felt the pressure to provide new levels of insight. In addition to their historical duties, accountants are now being tasked with providing information that can guide strategic business decisions. While the recent COVID-19 outbreak certainly brought the importance of finance insights to the forefront of everyone’s mind, this expectation will only continue to grow in the coming years.

However, in order to provide this insight, offices of finance need to future proof their processes by removing the time-consuming manual aspects inherent to their historic approach. Currently, for many organizations, the Record to Report process (R2R) is typically handled through spreadsheets and other manual methods. This approach is both inefficient and time-consuming, leaving little opportunity for CFOs to meet the new expectations to provide more value-adding strategic updates for the overall organization.

These two circumstances have left many wondering what exactly they can do to prepare their office of finance to meet these new demands, and how they can create and implement a more efficient and effective R2R process now and in the future.

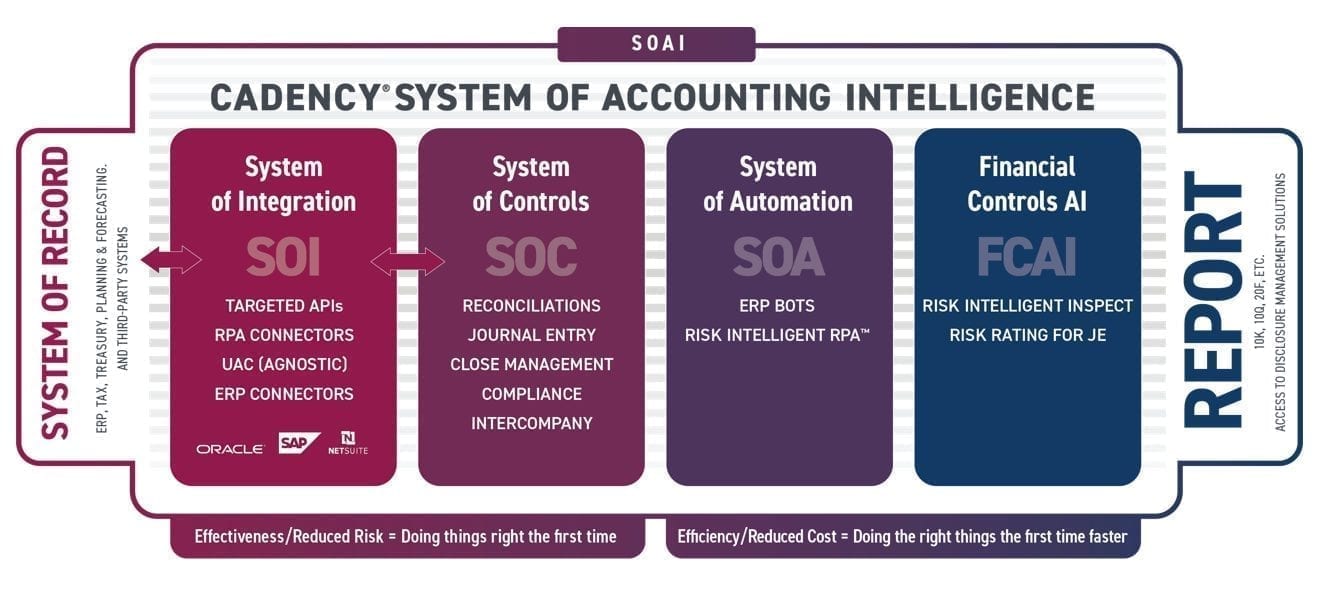

This blog details how the Cadency® System of Accounting Intelligence (SOAI) can help the CFO role transform into a guiding voice for the organization, as well as benefits that each part of an SOAI offers to the overall finance function.

System of Record

The first step in future-proofing your office of finance is maintaining a single System of Record (SOR) where the day-to-day details (such as transactions, balances, etc.) are fed into and housed. While multiple instances of this SOR can exist, having one system ensures not only that the data is in one place for everyone to access, but also guarantees its reliability and accuracy.

System of Integration

In order for your System of Record to work properly, you also need a System of Controls. However, for these two systems to interact with one another, a System of Integration (SOI) needs to be implemented. A System of Integration (SOI) consists of APIs, ERP Connectors, and RPA Connectors that enable one system to talk with other systems. As an example, the benefit of dedicated ERP Connectors is not just being able to get the data in and out of these systems, but also making sure the data is accurate and validated. Controls can then be put into place to help make sure the data is consistent. This is where a System of Controls comes into play.

System of Controls

A System of Controls ensures that your incoming daily transactions are matched properly. At the end of a period when you are reconciling accounts, a System of Controls ensures that all accounts are reconciled based on the controls you have set in place. Those can include controls related to industry standards or that are unique to your business. Additionally, this ensures that journal entries that need to be done as part of the financial close process are done properly with the appropriate approval process. It is key to note that these controls can be changed or configured not only with your unique use cases but also periodically as things in your business change. For instance, maybe an organization is involved with an M&A deal. If a large event like this were to transpire, controls would need to be edited appropriately.

System of Automation

Once your System of Record is fully integrated with your System of Controls, organizations will have the right controls and processes in place to drive automation. The System of Automation consists of Bots, Risk Intelligent RPA, etc. and is used to automate previously manual tasks in order for accounting teams to focus their time and effort on tasks that are more strategic to the business. As an example, Bots can run both inside your System of Controls and outside of it to trigger actions in both systems without human intervention.

Financial Controls AI

After automating as much of the process as possible, organizations have the capacity to look at process improvements. This is where Financial Controls Artificial Intelligence (FC AI) comes into play. FC AI’s provides preventative controls to manage risk during the financial close but also brings in detective controls after the fact just in case something was missed. With these in place, organizations can quantitatively evaluate risk across various elements of the R2R process in order to greatly reduce financial risk from multiple angles, while also saving time and resources.

Future-Proofing Your Office of Finance

The Cadency® System of Accounting Intelligence combines advanced automation technologies, such as Artificial Intelligence (AI), Robotic Process Automation (RPA) and Bots and strategically applies them to support the often complex and complicated R2R process from end to end. These technologies offer unique, powerful solutions to some of the most complex accounting challenges and readily scale as the financial transformation journey evolves and businesses grow.

To learn more about how the Cadency® System of Accounting Intelligence can help identify and remove risk from your R2R process check out this webinar.

Written by: Caleb Walter

Additional Resources: