How to Reduce Risk and Ensure Control Over Your Intercompany Transactions with Cadency’s Detective Controls

Blog post

Share

Intercompany is essentially the act of moving money from your left pocket to your right pocket – transactions between subsidiaries of the same company. However, because it is touched by so many members of the organization and has such a high risk, intercompany controls can become a sensitive part of accounting. The assets still belong to the company, but the difference lies where they are being accounted for. Companies pay additional close attention to these types of transactions because of tax jurisdictions, reporting expectations, currency discrepancies, and strict governmental regulations. Errors in any of these areas result in decreased efficiency, effectiveness, and will likely increase cost and risk.

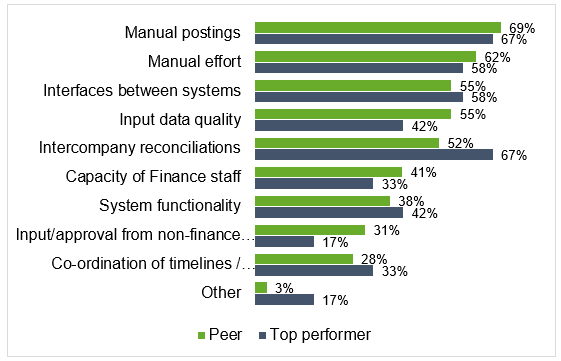

A 2017 study1 conducted by The Hackett Group shows that intercompany reconciliations are one of the largest bottlenecks in the overall Record to Report (R2R) process for top-performing companies. It is key to point out that the reason intercompany has become a high concern for these top-performing organizations is because these organizations have already taken the initial step in automating key processes in their R2R process such as account reconciliations, journal entries, close management tasks, etc. and are now looking to continue to automate this process further with the addition of intercompany.

A 2017 study1 conducted by The Hackett Group shows that intercompany reconciliations are one of the largest bottlenecks in the overall Record to Report (R2R) process for top-performing companies. It is key to point out that the reason intercompany has become a high concern for these top-performing organizations is because these organizations have already taken the initial step in automating key processes in their R2R process such as account reconciliations, journal entries, close management tasks, etc. and are now looking to continue to automate this process further with the addition of intercompany.

Trintech recently interviewed groups of existing customers to better understand the tasks and challenges around intercompany. Some of the top challenges listed were:

- Lack of or disparate technology

- Non-standardized processes across entities

- Transaction matching/account reconciliation

- Identifying and reconciling incorrect intercompany transactions after they occur due to messy data import and massaging

- Different ERPs set up across entities

From this research, we learned that to properly address these complexities and concerns, and to enable control and smooth orchestration of the overall R2R process, we needed to understand that intercompany accounting must be handled in the following three stages:

- Preventative Controls

- Detective Controls

- Period-end Reconciliation

Preventative Controls

Preventative controls address the process of preventing discrepancies between the buyer and seller’s books. These are often the non-trade activities – items like loans, fees, and taxes that you would want pre-approval on, which is why they are handled with our preventative controls. In preventative circumstances, both the company proposing the transaction and the purchaser agree on the transaction and the price that is going to be paid early in the process, which results in a journal entry. How can companies prevent issues down the line and solve a problem before it becomes a problem? We answer this question in our previous blog.

Detective Controls

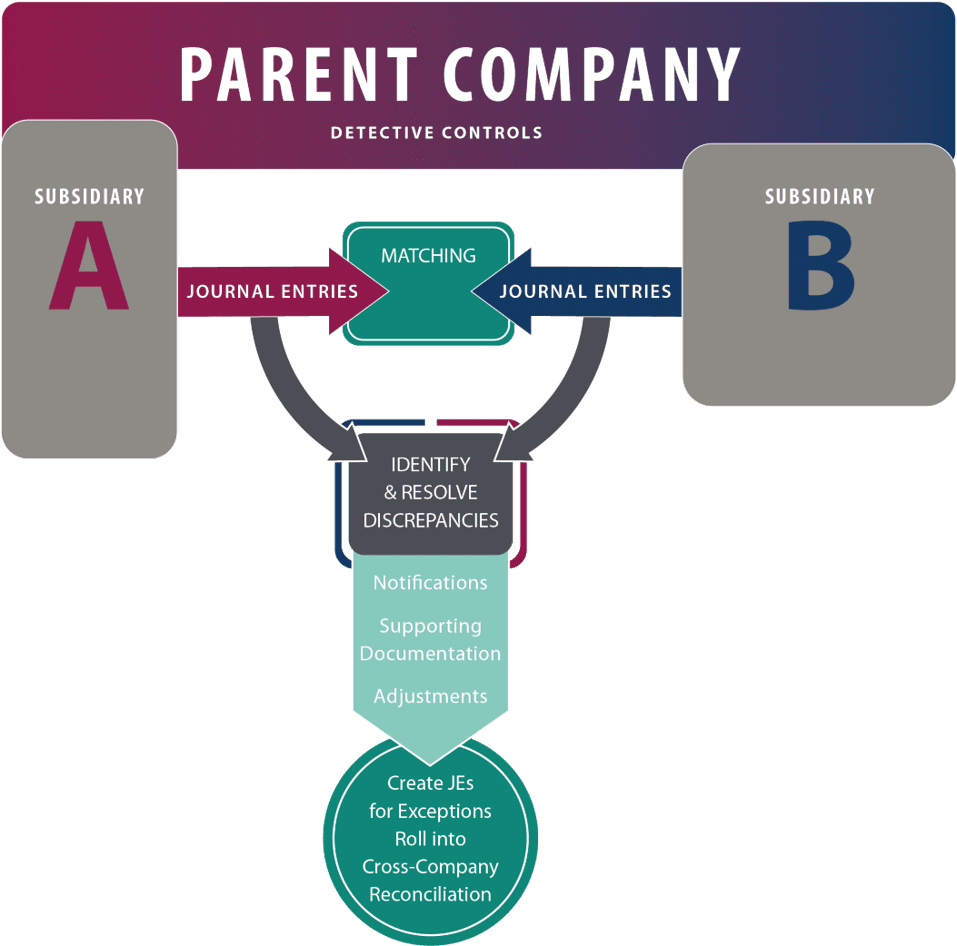

Detective controls include transaction matching and period-end reconciliation and determine if anything is out of balance between two subsidiaries. These are often called trade transactions. An example of a trade transaction would be a manufacturer selling shoes to the distributor. Because of the high volume and everyday occurrence of these types of transactions, a user would never expect pre-approval here so the likelihood of possible discrepancies may rise, which brings risk to your books. Another example is maybe one user enters 100 dollars and the trading partner enters it as 100 pounds. The discrepancy raises the risk that you are going to end up reporting on amounts that do not agree and are not accurate. Cadency by Trintech offers a process to investigate and resolve the discrepancies.

Period-end Reconciliation

Once final settlement has occurred, you can book your period-end reconciliation. This is your intercompany reconciliation as part of your month-end close process, further ensuring those controls are in place and that there are no accounts out of balance at the end of the month.

Cadency’s intercompany process handles intercompany detective controls efficiently and effectively, allowing a reduction in cost and risk for your company. To alleviate top challenges, we ensured our detective controls process enables users to reap the following key benefits:

Reduction in the number of FTEs needed to match daily transactions

- Companies who perform business across the globe likely have manufacturers, distributors, and sister companies world-wide, and these trade transactions are far too common and in mass to be expected to hire a team to manually approve each and every one. And yet, that is often what is happening. Users are having to look at every transaction and make a manual match before rolling up to reconcile. With Cadency’s intercompany process, rules and tolerances are easily set on a schedule to auto-match transactions so that users only need to review the exceptions. This approach saves companies time, money, and reduces risk of manual error when working with large numbers of transactions.

Work accomplished in one solution

- With Cadency’s detective controls, all transactions are imported, matched off automatically for your end user to then land on a single screen that shows all unmatched items to work on today. Users can also communicate with one another through this screen. Users no longer need to navigate back and forth to multiple systems or screens, and they can create journals and adjustments from our single solution. Reduction of disparate solutions allows for a seamless process across organizations and time saved jumping from email to Excel to the ERP to the matching solution.

One-time data setup and automatic import

- Cadency offers one-time setup and formatting of files, automatically transforming your data upon import. This means that when users come in, all data is in the correct format, organized, with no tweaking required.

User-defined matching rules automatically run before users start their daily work

- We understand that one of the first tasks users want to take care of in the reconciliation process are the exceptions, so we implemented user-defined rules and tolerances so that the right transactions will go to the right person who is best to handle the job. For example, unmatched transactions over $1 million are automatically routed to a manager. These risk intelligent rules allow you to work ahead of the risk, ensuring a secure process.

Leverages your existing Systems of Record

- We enable data from any source, across multiple ERPs. Enterprise companies who are set to rule the world have likely accumulated and consolidated many entities over time, inheriting new and different ERP systems, and likely include multiple sources as the System of Record. Cadency’s intercompany detective controls welcomes data from any source, whether you prefer to configure with a flat file or using our ERP connector to automatically import transactions and balances, or to pull data in from a treasury or tax system.

Using Cadency’s intercompany detective process as part of your overall intercompany accounting controls leads you away from disparate systems and processes, and toward overall control and risk reduction. Join over 20 existing enterprise customers such as Topgolf, Sysco, and GSK, who are already reaping the benefits, not only from a seamless intercompany process, but also a global set of Record to Report controls, using Cadency.

Next, we will take a glimpse into another set of state-of-the-art controls offered by Trintech, the Cadency Close process.

Explore the Full 7-Part Series on Trintech’s System of Controls:

Part 1: Don’t Drown in Transaction Data When Closing – Light a Match and See Clearly

Part 2: Reconciliations: Part of a Global System of Controls to Ensure the Integrity of Your Financial Close

Part 3: Eliminate 95% of Manual Journal Entries and Reduce Risk at the Same Time – Mission Possible

Part 4: (Intercompany) Prevention Is the Best Machine

Part 6: How to Excite An Accountant During Close

Part 7: How to Measure the Impact of Your Control Environment Using a Framework for Compliance

Written by: Kate Laverde

Additional Resources: