Is Your Current R2R Process Like Trying to Solve A Rubik’s Cube?

Blog post

Share

Record to Report (or R2R) is a Finance and Accounting (F&A) management process which involves collecting, processing and delivering relevant, timely and accurate information used for providing strategic, financial and operational feedback and reporting to understand how a business is performing overall. Trintech’s 2020 Global Record to Report Benchmark Report found that only 20% of organizations have “established” or “advanced” automation in place. However, research continues to reinforce that companies who fail to automate business processes will fall behind their competitors in the market who have adopted this technology.

Technology adoption beyond the ERP landscape tends to skip the office of finance. Binders, spreadsheets and manual processes are still widely used tools by many accountants. However, there are many issues that accompany these outdated tools, such as:

- Increase in the amount of errors (which affects the end financial reporting or insights provided)

- Lack of proper control framework throughout the Record to Report process

- Increase in compliance risk for the organization

- Decreased visibility and management ability over the entire R2R process

- Constant bottlenecks, such as rework, that affect timeliness

These issues affect your ability to compete with other organizations in the market that don’t face these challenges. But your current manual processes, utilizing lots of spreadsheets, can be a very complex system. How can you refine and transform your Record to Report process without crippling the entire organization?

Analyzing Your Current Record to Report Process

Imagine your current R2R process as a Rubik’s cube. Every Rubik’s cube has many faces and colors, and there are many techniques you can apply to solve it. However, there is a process strategy that enables the user to solve the Rubik’s cube in as few steps as possible.

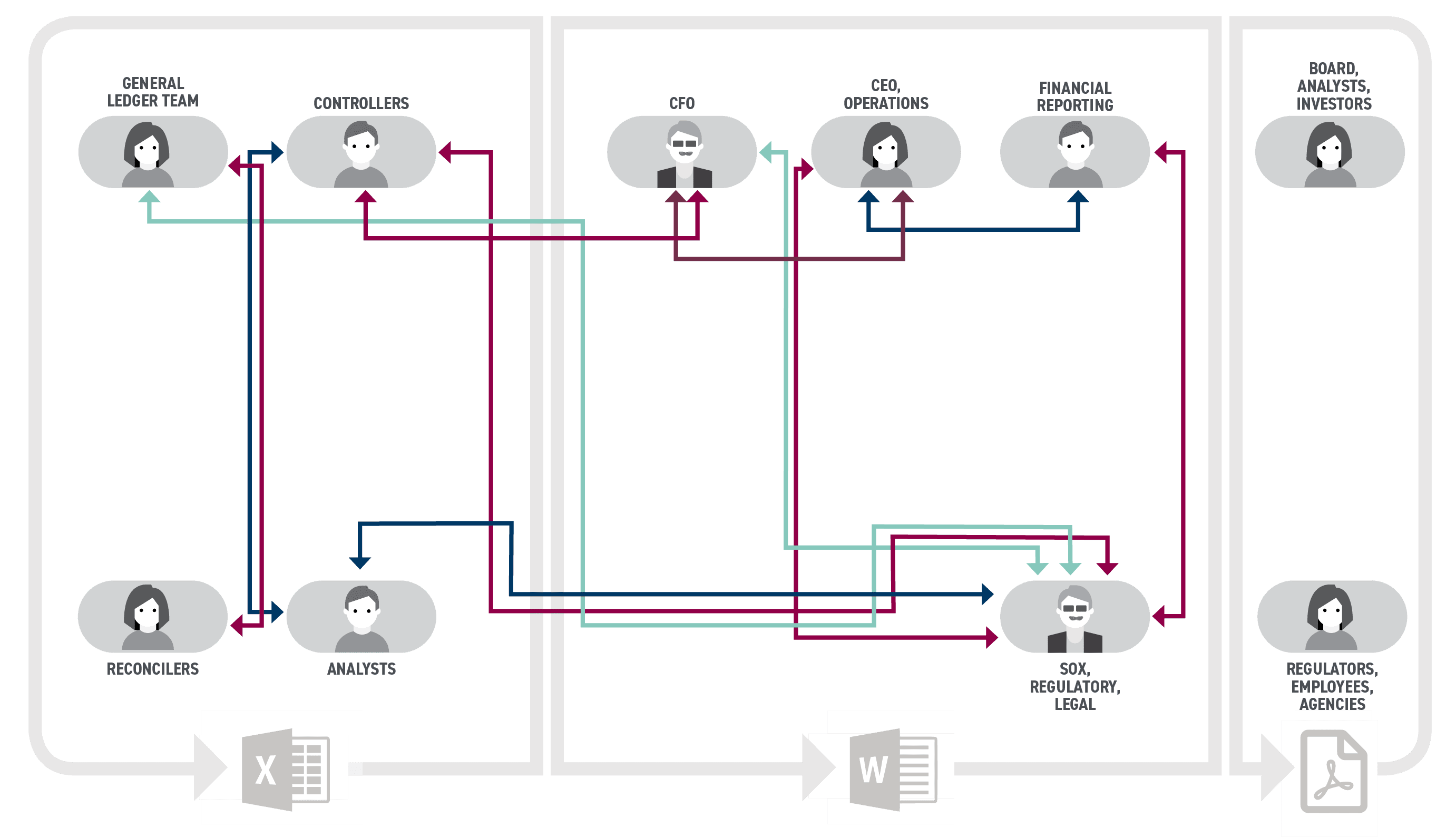

As an enterprise-level organization the start of your Record to Report may resemble something like this:

As you navigate the process of completing your Record to Report (a finished, color-coordinated Rubik’s cube) you are looking for the most efficient and effective way possible. But your current, spreadsheet-based processes don’t allow for many important factors like standardized workflows, proper controls, a reasonable approval timeframe and sufficient data analytics.

In trying to solve your Rubik’s cube, you are constantly testing and experimenting, but never discover a perfected, tried-and-true method of completing your Record to Report. When outlined, your process likely looks much like this:

With this approach, you are simply trying to beat the clock and hope for accurate financial statements. But it doesn’t have to be this way— your finance and accounting department can complete the entire Record to Report on time, create accurate financial reporting and still have time left to provide the organization with business-critical insights.

Transforming Your R2R Process

The importance of having visibility and control across your R2R process is paramount, especially for enterprise organizations who are often involved in complex processes such as intercompany transactions and subject to strict compliance regulations. Instead of constantly experimenting with manual processes and systems of spreadsheets the way one might with a Rubik’s cube for hours on end (and never really getting anywhere), allow a Record to Report expert to help.

At Trintech, our Record to Report experts can help take a look at your financial processes both holistically and granularly to discover the inefficiencies of your current processes, and share how you can transform them. Much like solving a Rubik’s cube, there is a streamlined way to complete your R2R process. Automated Close solutions, such as Cadency, solve your disorganized and complex Rubik’s cube financial processes for you.

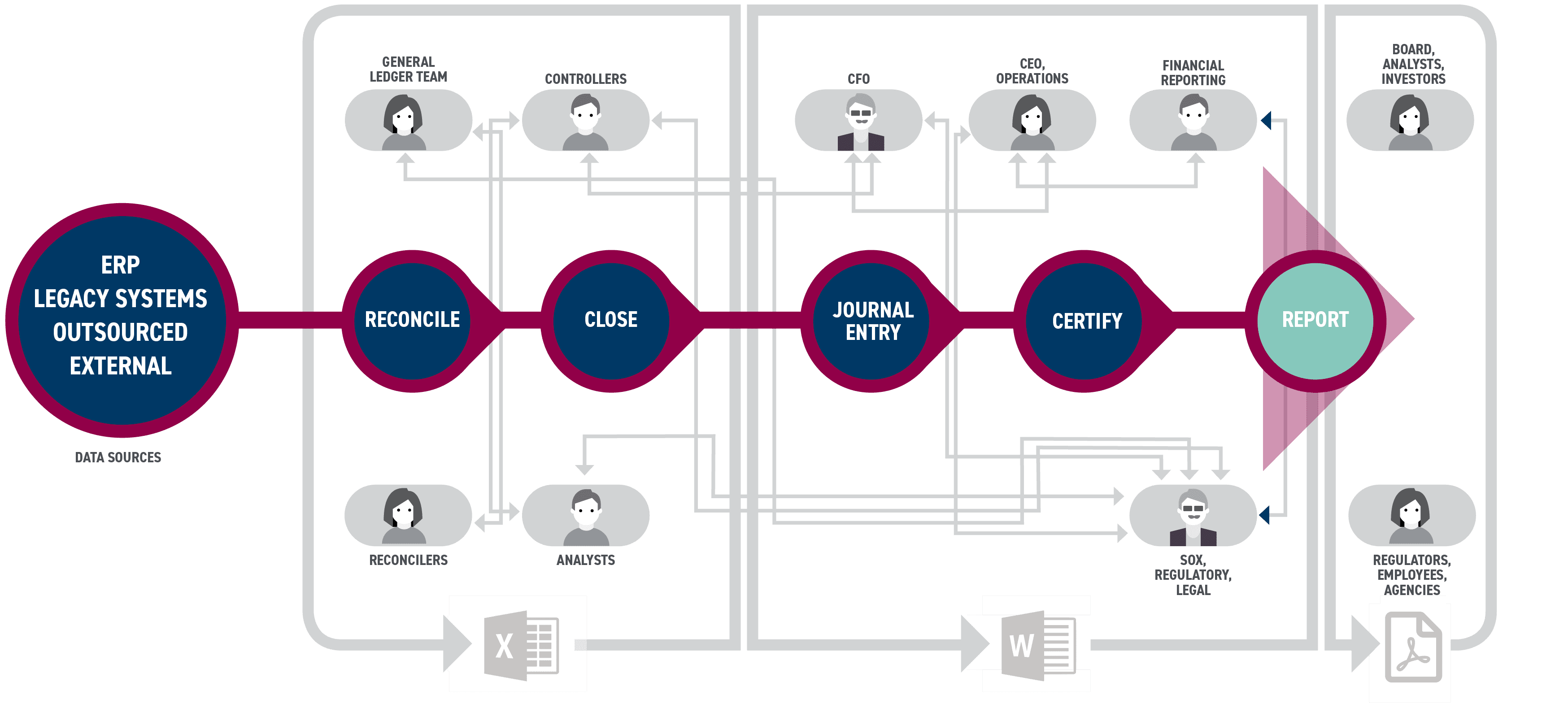

Industry-leading capabilities like Risk Intelligent Robotic Process Automation™ (RI RPA), ERP Bots, Financial Controls AI, will help drive efficiencies while reducing risk, to transform your Record to Report process to look something more like this:

Organizations that deploy Cadency see the following results:

- Reduce time spent on transaction matching by up to 80%

- Reduce the number of accounts to be reconciled by up to 90%

- Reduce resulting write-offs by up to 62%

- Reduce risk of revenue impact by up to 14%

Learn more about how Cadency and our Record to Report experts can refine and streamline your financial processes so you don’t feel like you are trying to solve a Rubik’s cube.

Written by: Ashton Mathai