Financial Controls AI: Artificial Intelligence

Blog post

Share

Have you heard that Machine Learning (ML) and Artificial Intelligence (AI) are enabling computers to win at chess, using weather data to improve profits and providing insights previously never imagined? It’s true, and Trintech is in the process of building out ML and AI technologies that help you improve your controls in your financial close process to detect fraud and lower costs without increasing your risk profile and still satisfying your audits. Trintech believes this will be the next revolution in financial close automation.

Have you heard that Machine Learning (ML) and Artificial Intelligence (AI) are enabling computers to win at chess, using weather data to improve profits and providing insights previously never imagined? It’s true, and Trintech is in the process of building out ML and AI technologies that help you improve your controls in your financial close process to detect fraud and lower costs without increasing your risk profile and still satisfying your audits. Trintech believes this will be the next revolution in financial close automation.

Within Cadency, Trintech has built up large datasets on how your users execute your system of controls and can compare them to your compliance framework which documents your risk profile. This means we know:

- How often your team approves GL reconciliations, journal entries and close tasks on a single day in the close cycle (n-5, n-1, n+10, etc.)

- How this varies by each person on your team

- How this varies by the materiality of the item (journal entry value, type, etc.)

- How this varies in comparison to the risk profile you have set in your compliance framework

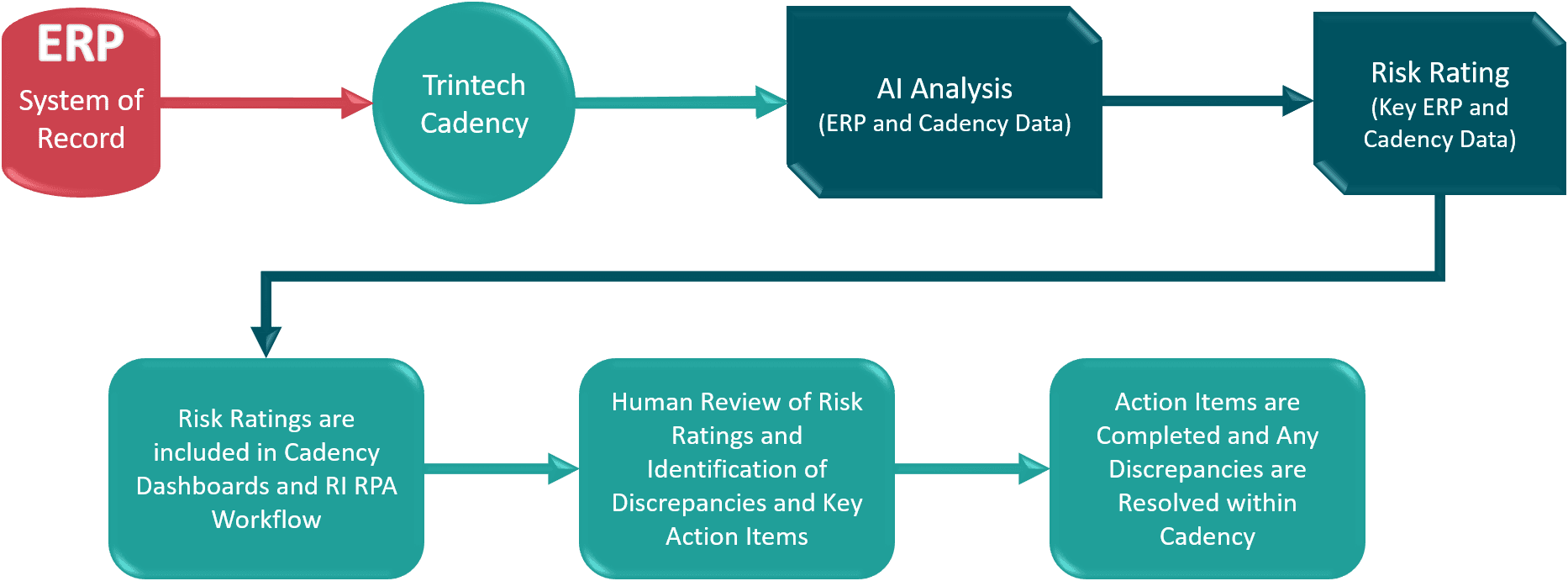

This is done by the Machine Learning engines that study the trends in your data over time to profile them and identify normalities (clusters of data points that look the same) and abnormalities or risks (data points that stand out) over time. For example, you have 20 journal entries that are auto-approved each n-5 day in your close and 3 which are manually approved by Joe above $100,000. These patterns and the supporting AI algorithms then examine items in the next close and look for alignment (low risk) and differences (high risk) and are then flagged by your risk profile in Cadency.

This functionality then enables Cadency (in real-time) to:

- Identify each GL reconciliation, journal entry, close management task and match for risk

- Return the risk rating back to the user for review as they work on an item

- Example: Low risk journal entries have a low number so when they are reviewed for manual approval, it can be done quickly and with confidence

- Enable the Risk Intelligent RPA™ functionality in Cadency to look at these so that if you auto-approve journal entries or GLs with a low risk rating (example you normally auto approve under $100,000 journal entries but now may choice to auto approved under 200K with a low risk rating) and also trigger a manual review even if the monetary value is low but the AI risk rating is high

- Enable reports so you can document who the ML/AI engine identified high and low risk items which substantiate your controls and your activity

Our goal is that via ML and AI, we will continue to improve efficiency and effectiveness, reduce cost and risk all in the goal of enabling you to produce non-restatable financial reports. Trintech is actively developing these capabilities and is excited to be bringing this innovation to market in a way that leverages the customers system of record in their ERP system, their system of controls in Cadency and drives unique value.

Written by: Michael Ross, Chief Product Officer at Trintech

Explore the Full 8-Part Series on Trintech’s Record to Report Automation Framework

Part 1 – How a System of Controls Can Move Your Financial Reporting from Flipping a Coin to a Sure Investment

Part 2 – How to Improve Controls, Reduce Risk and Lower Costs with a System of Accounting Intelligence

Part 3 – System of Integration: ERP Connectors

Part 4 – System of Integration: APIs

Part 5 – System of Automation: ERP Bots

Part 6 – System of Automation: Risk Intelligent RPA

Additional Resources: