Shared Services in Finance and Accounting

Blog post

Share

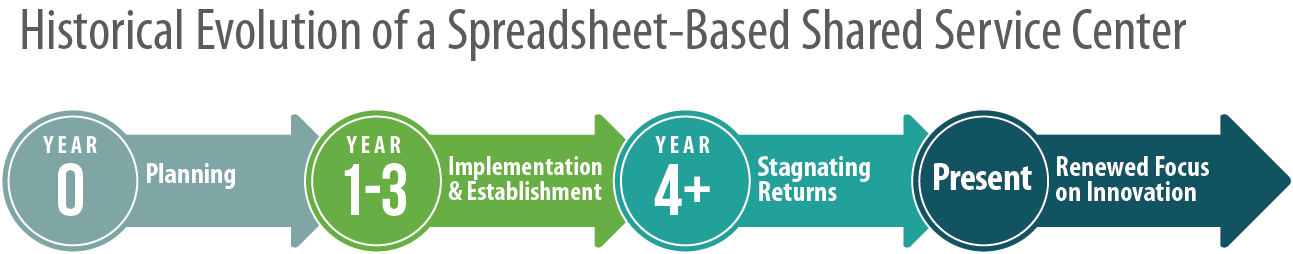

Historically, companies have chosen to consolidate their office of finance’s operations to a shared service center (SSC) as a cost-saving measure that drives efficiency and standardization. However, according to the Shared Services and Outsourcing Network, there’s been increased focus on data analytics and long-term ROI over the past couple of years, particularly with companies in the planning stage of their future SSCs.

There’s been quite a bit of discussion around automating repetitive tasks and empowering Shared Services to provide new levels of value to the overall company – and it appears that companies in the planning stage have taken the initiative by leveraging automation to remove the manual tasks typically associated with SSC. This enables the SSC to move away from spending FTE on easily automated tasks and more towards the more value-adding tasks.

While we all know that implementing a priority is a lot harder than identifying it, this is a promising trend for companies new to the SSC scene in providing a level of value that would set them apart from the more tenured SSC.

Years 0-3-Implementation

Traditionally, because of the complexity of moving large-scale operations to a centralized location, most companies tend to focus on transactional work in their initial implementation and planning stages of a SSC. Although manual tasks provide a solid ROI foundation during the centralization process, they can be easily automated within these SSCs to provide both long-term and more substantial returns.

Automating repetitive manual tasks frees up the centralized operation’s valuable time, allowing them to focus on more value-added knowledge-based tasks, such as data analytics. Ultimately, automation provides both the value of a traditional SSC and the increased ability to not just process the data, but to identify how it impacts the company.

Unfortunately, of the surveyed respondents1, compared to other maturity levels, companies within the 0-3 year range had the lowest priority of data analytics. Regrettably, this suggests that there’s been an attempt to imitate their predecessors to achieve the same level of short term ROI. However, that imitation quickly comes with the same problems of an unsustainable long-term ROI. The 0-3 maturity level SSC will initially see double-digit cost savings, but like their more experienced counterparts, those cost savings will level out. However, as time goes on, that decision will begin to cost them a sustainable, long term ROI due to time wasted on manual tasks that could be easily-automated.

Where to Go Now

Despite the difference in focus between the maturity level of “planning implementation” and “recently implemented” within the SSC world, the solution for a long-term ROI is the same. SSCs have the potential to revolutionize the finance and accounting processes of companies worldwide but continuing to approach the financial close’s repetitive tasks through manual processing inhibits that potential. And any growth that stems from the SSC will eventually run into the same issues of the decentralized system.

Written by: Caleb Walter and Ben Cornforth

1 Hodge, B. (April 18, 2018). Annual report based on SSON membership survey. Retrieved October 2018, SSON.

Find this content helpful?

If you loved this blog, there’s more where that came from! Discover additional ways that Trintech can help you streamline your financial processes: