System of Controls for Financial Planning and Forecasting

Blog post

Share

Strategic Planning is one of the core functions of the Office of Finance, which includes Forecasting, Budgeting, and periodic Analytics. While planning is usually a 3-5-year activity, budgeting breaks it down into a month-to-month execution plan with estimates on revenue, expenses, cash flow, debt, etc. This execution plan then tracks forecasts against actuals and helps in performing variance analysis to gauge business performance and make any necessary adjustments to the plan and/or forecast. The entire Planning needs to be holistic, considering all aspects of finance including all the cost centers and entities involved. Only then can the budgeting be accurate and reliable. If done manually, these activities can be very time-consuming, creating inefficiencies across the business, and increasing overall financial risk for the organization.

To mitigate these challenges with the manual processes, there are software tools available to help with the entire planning and budgeting process. They make it easy to centralize the financial information and automate the overall budgeting process across multiple business units, entities and geographies. These solutions are available standalone and sometimes as part of Corporate Performance Management (CPM) solutions. They help create efficiencies throughout the FP&A process, provide visibility into the plan and forecasts, and reduce the risk of manual errors, increasing the confidence of the CFO in the overall process.

But, how does the Office of Finance ensure that proper variance analysis is done when actuals come in without any significant manual effort, and necessary adjustments are made in time with appropriate review and approval, along with visibility across management and leadership? This is where a System of Controls can help.

A comprehensive System of Integration paired with a robust System of Controls can take forecasted/budgeted figures from a Planning and Forecasting tool, and compare it against actuals from the System of Record (ERP, etc.) during the period-end close, enabling true variance analysis between the planned and actual figures, and the ability to drill-down into any discrepancies, errors or misstatements. Furthermore, it allows for any adjustments to be posted directly to the System of Record following a dynamic review and approval workflow based on quantified risk, with back-up documentation and necessary visibility. It also provides the ability to collaborate in real-time, capture audit history of any changes and reviews/approvals and provide on-demand reporting, as necessary. Ideally, it provides an automated way of calculating Variance Analysis, along with necessary visibility and, review and approval workflows before it is finalized, and the adjustment process starts.

Cadency is one of the strongest System of Controls built for the needs of Finance Professionals working on FP&A activities within large, complex organizations. It also has a configurable and robust compliance framework, making it the first choice for hundreds of CFOs across the world. Cadency’s System of Integration provides easy integration capabilities via APIs to a Planning and Forecasting and/or CPM tools.

Now, let’s see a use case where Cadency’s System of Integration can work seamlessly with the System of Record and a Planning and Forecasting solution to help automate the variance analysis process, along with reducing risk and increasing governance around the adjustment process.

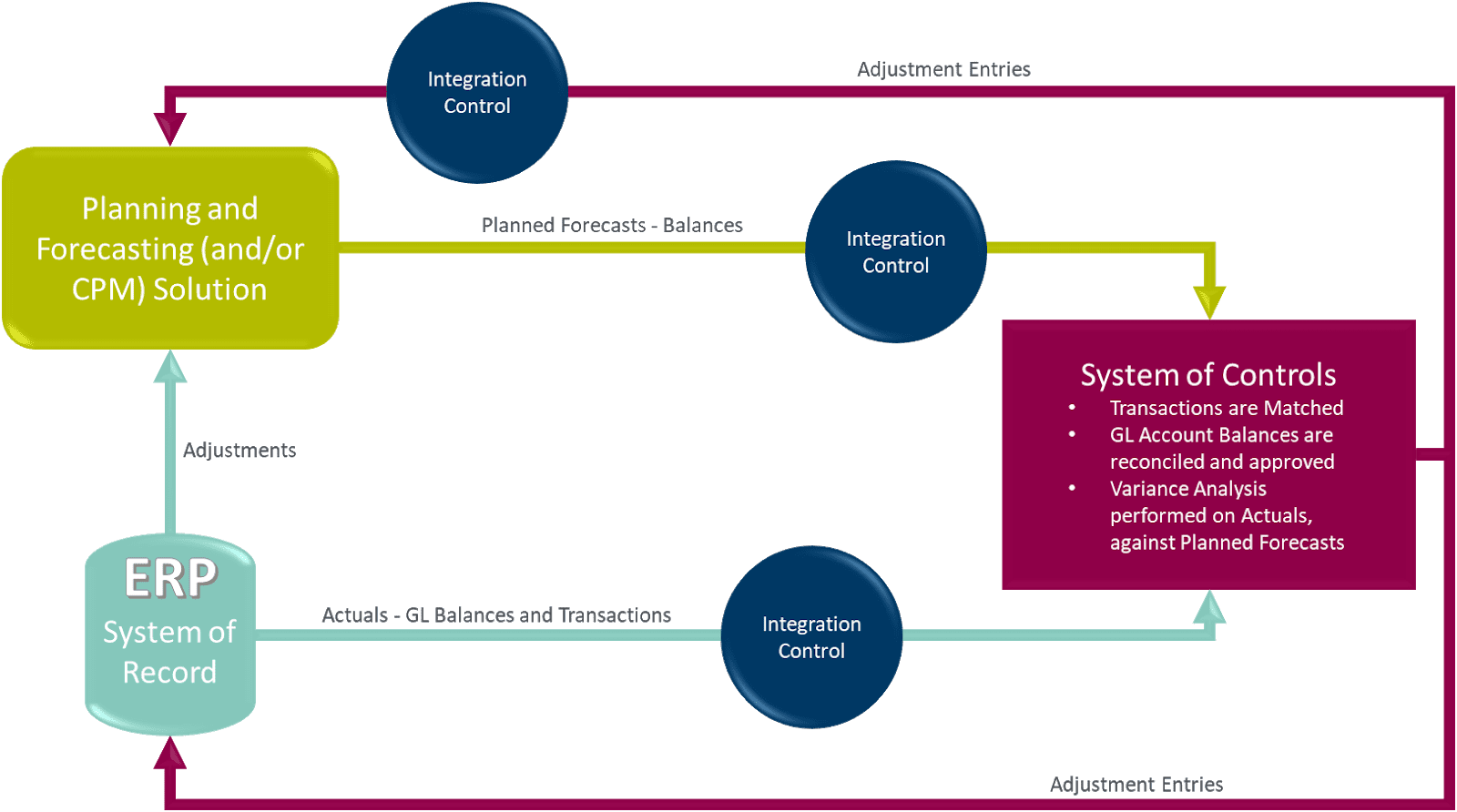

In the use case explained via the workflow diagram below, planned budgets and forecasts including projected account balances, are sent to Cadency from a Budgeting and Forecasting tool, via direct API integration. As actuals are captured in the ERP, they are also fed directly into Cadency in the form of GL data (including balances and transactions) along with any necessary transformation occurring during the extraction and load process, either via a dedicated connector or an API integration. Cadency can then compare the 2 data sets and provide the capabilities for a true Variance Analysis at the period level, entity level, account level, etc. as needed by the financial professionals. This variance analysis can then be used to make any necessary adjustments to the system of record by posting one or more entries directly from Cadency, while following a controlled approval process. This process is collaborative via workflow options and visible through dashboards and reports, ensuring that any anomalies are caught throughout the process and all adjustments are accurate with proper audit history.

Once the adjustments are posted to the system of record, they can be reflected in the Planning and Forecasting system via existing integrations with the ERPs. Cadency can also be set-up to post these entries directly to the Planning system in addition to the ERPs, still following risk-based configured workflows and preserving the audit history. This gives additional flexibility and risk-mitigation options when utilizing Cadency to incorporate proper controls in the FP&A process.

An overview of System of Controls and Integration for Financial Planning and Forecasting

With Cadency’s industry-leading System of Accounting Intelligence, customers can leverage its automated control capabilities to make their Planning, Forecasting, and Adjustment process effective and efficient by eliminating the manual steps involved and reducing global risk.

Our goal here at Trintech is to reduce risk in all aspects of the financial controls and Record to Report process and help drive best practices within various Offices of Finance, helping them become a key strategic partner for the business. We enable our customers to drive an efficient and effective Close process, and also create a streamlined and efficient Forecasting and Adjustment process, increasing their confidence in their period-end Financial Statements and freeing up their valuable resources to focus on key long and short-term high-impact business initiatives.

With Cadency, it is not just about doing things efficiently to reduce costs, but also about doing them effectively to reduce overall risks within the global R2R process.

Written by: Dhawal Godhwani – VP of Product Management, Trintech