The Importance of Technology in Lowering Risk, Competing for Talent, and Reducing Costs

Blog post

Share

Written by Bill Marchionni, Account-to-Report Advisory Global Program Leader, The Hackett Group

Business uncertainty today is unprecedented. CFOs and Controllers need to be steady and decisive:

Businesses continue to face bundles of uncertainty and risk: inflation, marketplace, geo-political, and environmental. Simultaneously, businesses need to transform and manage operating complexities: technological, product (service) offerings, pricing, operational and financial.

CFOs and Controllers have challenges. They must identify uncertainties and mitigate risks. They need to ensure that the enterprise is cost-competitive and agile. They need to compete aggressively for talent and develop new organizational capabilities. They need to prepare for increasing regulatory oversight.

These finance executives must determine and drive a winning strategic vision, transform the enterprise, and ensure operational excellence. Not for the faint of heart.

CFOs Are Increasingly Responsible for More Risk. Foundations Remain Fundamental.

Today, CFOs are expected to be strategic drivers of value. Business risks they confront include:

- Marco-economic problems

- Industry disruption / sector maturity

- Substitute products and services

- Competitive pressures on price and market share

- Technology obsolescence

- Political risks and adverse government policy

- Tight capital availability and liquidity

- Unpredictable supply chains

Within this context, CFOs and controllers are expected to flawlessly manage financial and compliance risks and, increasingly, broader enterprise risks:

- Cyber security breaches

- Process risk (e.g., breakdowns of procedures, systems, controls)

- Fraud or misuse of financial resources

- Regulatory non-conformance

- Mitigation of exposure to market risks (e.g., financial, operating

- Decision making based on incomplete or faulty information

- Unfulfilled promises to investors

- Litigation risks

CFOs and Controllers have more reasons than ever before to drive a highly functional, agile, and scalable finance operating model. Foundational elements of a top performing operating model include:

- Clean data and formal ongoing master data management governance

- Robust financial systems and internal controls

- Concise, lucid reporting tools

- Predictive and prescriptive forecasting capabilities

- Strong working capital management practices

- Informed hedging decisions and sophisticated risk programs

- End-to-end governance with clear and strongly supported decision rights

- Mature leveraged services model

CFOs and Controllers Look to Technology to Fill Productivity and Efficiency Gaps

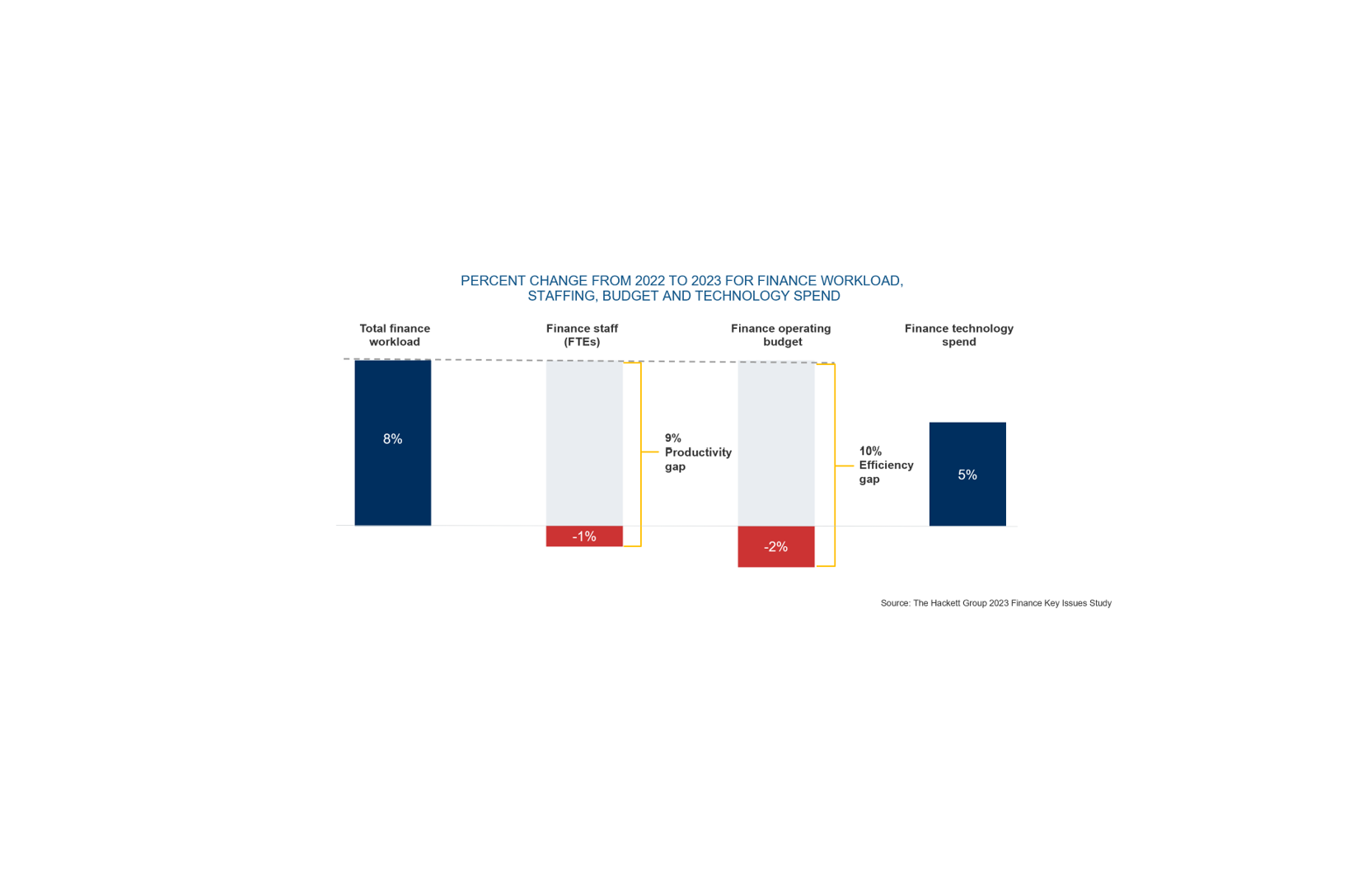

According to a recent study by The Hackett Group®, CFOs and controllers are facing increased workloads coupled with productivity and efficiency gaps. More specifically, the Finance function is expecting an 8% increase, at least, in workload. At the same time, they expect staffing reductions, and reductions in the finance operating budgets.

All this results in a 9% productivity gap and a 10% efficiency gap. In response, while balancing their efforts to steer organizational change, CFOs are increasing their year-over-year technology spending by 5%.

Competing for Talent

Fifty-four percent (54%) of Finance executives surveyed by The Hackett Group® identified talent shortages and the inability to fill critical roles as a top enterprise issue. Multiple factors contribute to this, including the expectations of today’s professionals. Skills and capability development are high on the list of the desires (demands!) of finance and accounting professionals today. They are looking to be on a learning curve (continuous) on which they get rapid and repeated exposure to business issues, problem-solving, leading and emerging technologies, and leadership positions.

Companies that have digitally transformed, or are legitimately on that path, have been better able to attract, retain and develop highly productive and valuable teams. It turns out that driving operational efficiency and value delivery practices creates in-demand learning and development opportunities.

Lowering Cost

Cost management remains core and critical to the CFO. CFOs are aggressively looking to improve the ROI delivered by the enterprise and by their organizations. As previously noted, CFOs are looking to operate with a 2% lower operating budget compared to last year. With persistent inflation, the real dollar reduction will need to be greater.

CFOs are looking strategically and tactically at cost structures. Strategically, they are focused on the fixed vs. variable equation. Additionally, they are looking at costs across dimensions (e.g., across the enterprise, by function, cost per transaction, employee productivity).

Long-term and short-term working capital needs remains critical drivers to CFO decision making.

Final Thought – CFOs and controllers need to:

- Digitally transform at scale

- Retain the right skills and talent

- Create actionable insights

- Improve finance agility

Select companies are thriving during times of external uncertainties. They are succeeding because they are mastering complexity at scale while effectively managing and mitigating the impacts of economic recession, inflation, talent hiring, retention challenges, and ongoing geopolitical risks. Leading organizations are achieving this by maturing their digital technology deployments along with employing best practices, resulting in accelerated digital transformation and step-change performance improvement.