The Inevitability of RPA in Finance and Accounting – Pressure to Further Reduce Cost

Blog post

Share

In our debut blog, we unpacked the demographic realities supporting the ongoing emergence of Robotic Process Automation (RPA) within Finance and Accounting. In part 2 of this 3-part blog series, we will delve into the business undercurrents which not only support this transformation, but perhaps even accelerate it.

These business “meta-trends” can be thought of as two reciprocal tendencies:

- A path towards ever reducing cost of delivery, while preserving quality

- A desire to aggressively scale business while maintaining a slower or even marginally reductive cost of labor within Finance and Accounting. Put plainly, companies want to scale, but don’t want to have to hire people and herein lies the fuel which will accelerate the adoption of Robotic Process technology.

I. Roboshoring

“Roboshoring” is the current in vogue term describing the notion of transitioning labor from outsourced/offshored, human-centric processing to automated “machine-centric” processing.

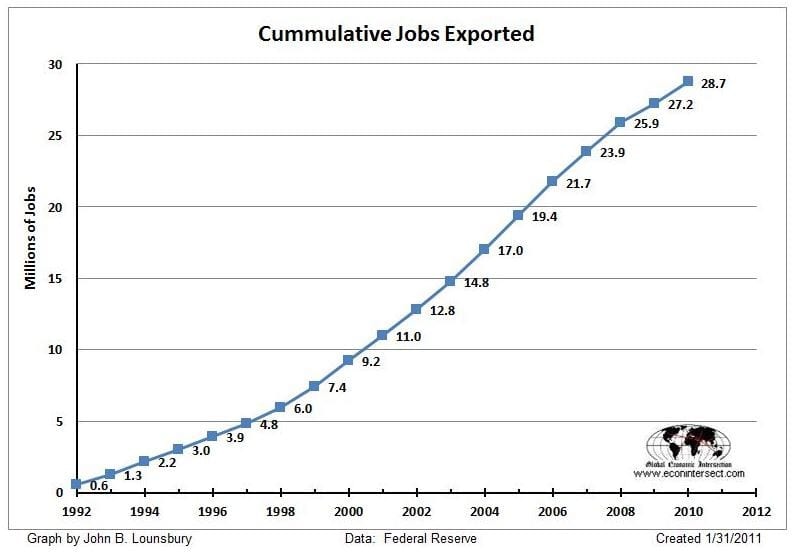

Commencing in the 1990’s enterprises engaged in a virtual “land rush” to migrate cost-intensive, back office operations to offshore/outsourced providers in order to take advantage of lower cost labor. Chief among these back-office operations was Finance and Accounting (US Bureau of Labor Statistics, December 2008). With an eye towards lower cost and a desire to capture this “labor arbitrage” as rapidly as possible, many enterprises simply lifted and shifted their current onshore business to these remote delivery models. Predictably, the result in many cases was a lower labor expense, but an offset increase in errors and re-processing which mitigated the overall value. In Deloitte’s 2014 Global Outsourcing and Insourcing Survey, they cited “…a small but growing reversal, where companies that have previously offshored functions are bringing them back.” The survey pointed to, “issues around quality of work as well the inability to achieve cost targets as the primary drivers.” Taken in totality and viewed against the background of increased regulatory risk and data security concerns, many organizations have begun to question the premise of offshoring/outsourcing (CFO Magazine, May 13, 2015, US Firms Eyeing Benefits of Onshoring).

Commencing in the 1990’s enterprises engaged in a virtual “land rush” to migrate cost-intensive, back office operations to offshore/outsourced providers in order to take advantage of lower cost labor. Chief among these back-office operations was Finance and Accounting (US Bureau of Labor Statistics, December 2008). With an eye towards lower cost and a desire to capture this “labor arbitrage” as rapidly as possible, many enterprises simply lifted and shifted their current onshore business to these remote delivery models. Predictably, the result in many cases was a lower labor expense, but an offset increase in errors and re-processing which mitigated the overall value. In Deloitte’s 2014 Global Outsourcing and Insourcing Survey, they cited “…a small but growing reversal, where companies that have previously offshored functions are bringing them back.” The survey pointed to, “issues around quality of work as well the inability to achieve cost targets as the primary drivers.” Taken in totality and viewed against the background of increased regulatory risk and data security concerns, many organizations have begun to question the premise of offshoring/outsourcing (CFO Magazine, May 13, 2015, US Firms Eyeing Benefits of Onshoring).

But, what to do? How do we improve the overall timeliness and quality of the end deliverable without increasing our labor cost? The windfall having been had, a return to the antecedent status-quo is not possible.

With an early indicative trend toward diminishing returns for human-centric resources, the next logical inflection point would be to replicate our best and brightest within a scalable technology framework which would lend itself to continuous improvement and unbounded scale. Consider this, more so than nearly any other process in the modern enterprise, General Accounting activities, such as volume and period reconciliation, journal entry preparation and close management exhibit somewhat predictable, rule-driven tendencies (Fast Company, August 2016). But before we draw this bright-line, let us investigate another challenge, that of scale.

II. Challenges with Scale

Intertwined with the concept of Roboshoring and the diminishing returns of human-centric processing, is the challenge business’ face with aggressively scaling the top line without proportionally scaling cost. Whether scale is achieved through organic growth or through acquisition, the push to grow revenue is as constant and unrelenting as the wind. Herein lies the challenge, the fastest way to scale is to hire people, it is also the most expensive over time. Further, as the business cycle matures the unfortunate necessity is that cost becomes a concern, and Finance and Accounting are a clear cost center. So, it goes…businesses inflate labor as the business cycle accelerates and then purge as a cost control measure in order to maintain margins during periods of recession. This process repeats over and over again.

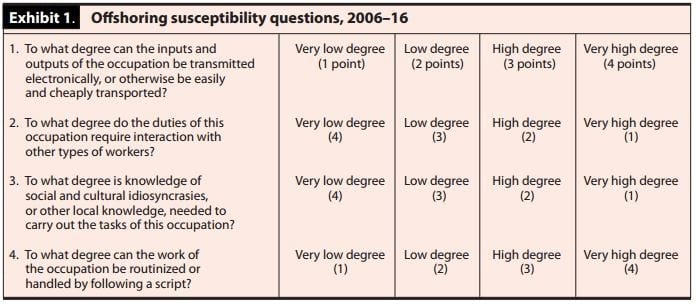

Therefore, in order to achieve scale without having to increase cost comparably many companies are turning to the same sort of reflective analysis (above illustration) that they used to assess the viability of moving labor to an offshore/outsourced model in the first place. However, in this instance rather than replacing the onshore labor with a similarly skilled worker in a remote location, business is turning to Robotic Process Automation (RPA). Succinctly put, RPA represents the opportunity to encode within a technology framework the attributes of our very best Finance and Accounting professionals without dependence on the human. Further, RPA processes never “call in sick”, decide to look for greener pastures or must be “let go” in order to control cost. Moreover, current thinking is that RPA, even in these relatively early stages, represents an immediate savings of 15% when compared to offshore labor and a stunning 60% when viewed against onshore alternatives (Everest Group 2015 FAO Annual Report).

In our final blog, we will review the current state of RPA technology, it’s enablers and perhaps most importantly, what this inevitable transformation means for the accounting profession itself.

Written by: Ben Cornforth