Turning Balance Sheet Reconciliation Risk into Confidence

Blog post

Share

Nothing affects an Office of Finance’s credibility more than a poorly-managed balance sheet reconciliation process — but how does an organization effectively anticipate potential errors and risk when managing numerous spreadsheets and documents?

Controlling financial risk is a high priority for any organization; if done inadequately, errors in financial reporting can lead to unintended, long-lasting consequences. The close process should be a way to clearly determine your financial position, but it’s crucial to understand that risk isn’t always easily detectable.

Sources of Balance Sheet Errors

The risk of human error significantly increases when manually reconciling balance sheets. Not only is it particularly difficult to accurately track changes made in spreadsheets, but keeping tabs on different versions of documents can be overwhelming. In addition, anyone with access to the spreadsheet can edit it, contributing to a lack of control over the organization’s reconciliations. Errors made within spreadsheets can be caused by a simple mistake made during the data transfers from your ERP software or within the spreadsheet itself.

Even if the reconciler believes that their work is error-free, the smallest mistake can severely impact the overall reconciliation process. Therefore, it is crucial to establish a comprehensive control framework to reduce errors and mitigate risk.

The Three Lines of Defense Model

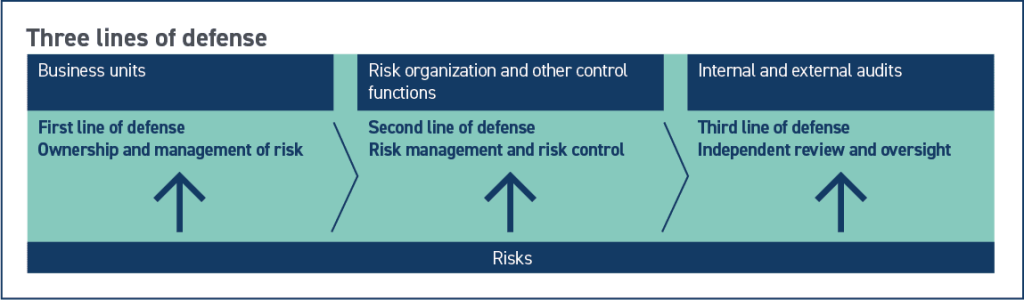

Businesses can no longer rely solely on an auditor to catch mistakes; organizations must prove that their internal staff is capable of catching errors and identifying emerging risks. In order to gain complete control of the financial close process, companies should implement a Three Lines of Defense (3LOD) model.

Using the 3LOD model ensures that an effective financial risk management framework is in place for the organization. While this framework has been standard for many years, organizations should continue to evolve their risk management strategies over time to remain forward-looking and create long-term value for the organization.

First Line of Defense

The first line of defense relies on the business units within the organization. Both management and process owners must manage and own the risks within daily operational activities. On this level, it is important to evaluate the tools that accounting utilizes within the reconciliation process and how they manifest a high level of risk.

A Forrester study revealed that while frontline accounting workers are very aware of the immense risk spreadsheets bring to the company, one-third of management chooses to overlook these problems. This leads to the harsh reality that many C-level executives are making impactful business decisions on data they believe to be accurate, but is, in fact, not.

Ignoring the liabilities associated with spreadsheets is no longer an option for organizations. Elevate the reliability of the reconciliation process’s data by investing in a financial automation solution to identify and resolve risk at the first line of defense. By implementing an effective control framework with the creation of custom pre-defined rules, financial automation software can flag the exceptions early.

Second Line of Defense

Risk organizations in small- to mid-sized companies should manifest as a board risk committee. This second line of defense identifies risks that are beginning to emerge in business operations. By providing oversight and expertise, the second line of defense should create effective policies and additional assistance to further support financial risk mitigation.

Third Line of Defense

The internal auditor acts as the third and final line of defense. They pick out any remaining errors to further improve the risk control and management process before the external audit. If an effective risk mitigation strategy is implemented in the first and second lines of defense, the internal auditor will be able to accurately assess the risk control operations set forth. The auditor will also provide assurance to external regulators that the control framework enforced has proved effective.

While the internal auditor should remain objective and independent of the first and second lines of defense, the role of this auditor should evolve over time to further support technologies and amplify business strategies.

The Control Challenge CFOs Face

As a CFO, your responsibility is to investigate emerging technologies and ideas, as well as capitalize on your financial team’s “cognitive surplus” to discover more effective solutions for financial processes.

These three lines of defense are great for investigating and resolving sources of risk in the financial reconciliation management process, but the traditional framework should evolve to fit the needs of your organization. For small- to medium-sized businesses, risks are often due to human error, so a single solution that allows you to move away from risk-laden spreadsheets and legacy tools must be comprehensive and specifically designed to combat these challenges.

When done accurately, automating your balance sheet reconciliation process can provide an effective executive-level risk control framework by minimizing human error that may present in the first line of defense, while also providing a strong audit trail and accountability level. Combined with the 3LOD model, financial automation can ensure all emerging levels of risk are mitigated. This guide to reconciliation management can help your finance organization navigate the modern face of finance.

“We have a large volume of transactions and Adra Balancer and Adra Accounts ensure we have a straightforward overview of these transactions and save us time at period end. As part of internal checks, Adra Task Manager is worth its weight in gold.” – Proctector Insurance

Written by: Alex Clem