What is a Journal Entry?

Blog post

Share

A journal entry is a record of a business transaction. A company’s accounting system is built on countless journal entries, whether they’re recorded on paper, entered by hand or automatically into a computer program, or created using some combination of multiple methods.

Journal entries record the entire spectrum of monetary transactions performed by a business, including the buying and selling of goods and services, expenses, company payroll, sales commissions, interest payments, depreciation, asset sales, and more.

Journal entries are key to ensuring the financial integrity and viability of a business. They enable the accounting team to assign transactions to the proper department or account, are used to help create summary documents, and form the basis of the information used to create financial reports and determine budgets.

Journal entries can be useful in ferreting out waste and fraud as well as providing investors with the information needed to evaluate a company’s performance. The information gleaned from journal entries also plays a role in determining a company’s tax liability, so it is extremely important that they be both timely and accurate.

The Features of a Journal Entry

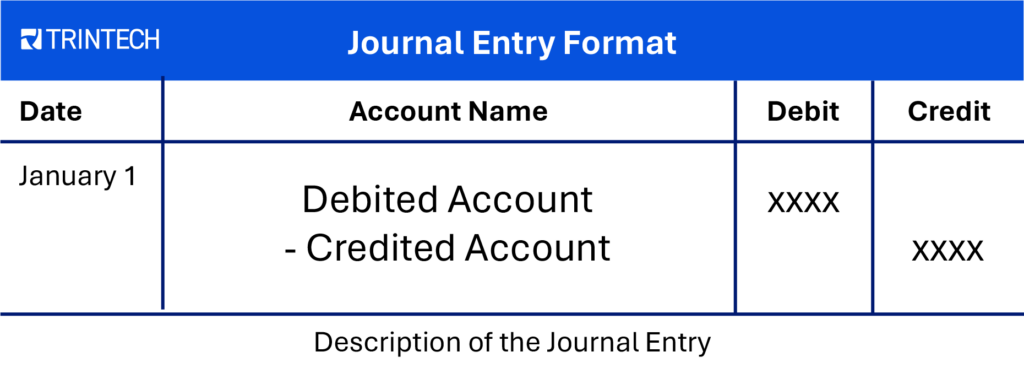

A typical journal entry comprises several basic elements including:

- Date the transaction occurred

- Account name and number under which the entry will be recorded

- Amount to be credited and debited

- Brief description of the transaction

- A unique reference number

Journal entries and double-entry bookkeeping go hand in hand. Double-entry bookkeeping is a system based on the premise that every financial transaction affects a business in both a positive and negative fashion.

For instance, if a company purchases new equipment, it increases the value of the company’s fixed assets. At the same time, however, the amount paid for the equipment represents a new debt that must also be accounted for.

Different Types of Journal Entries

The average business makes 6 different kinds of journal entries:

Closing Entries

A closing entry denotes the end of an accounting period. The recorded balance can then be transferred from one account to another or simply forwarded into the next accounting period, where it will be recorded as an opening entry.

Opening Entries

Once an accounting period has closed, the ending balance is carried over into the new accounting period and recorded as the beginning balance of the new accounting period. So, if the ending balance of the previous period was £10,000, that will be the beginning balance recorded as an opening entry in the new accounting period.

Transfer Entries

Transfer entries record income, expenses, or assets that are transferred from one account to another. For example, if a company transfers money from its main account to that of a subsidiary, it is recorded as a transfer entry. No third parties are ever involved in transfer entries.

Adjusting Entries

Adjusting entries record changes to accounts that have no other record in the journal at the time they are made. For instance, an expense accrual entry may record the cost of electricity used by an office before the utility has issued a bill.

Compound Entries

Double-entry bookkeeping requires there be an equal debit for every credit, but there does not need to be an equal number of debits for every credit. A single credit may produce two or more debits. Likewise, a single debit may produce multiple credits.

Reverse Entries

The purpose of a reverse journal entry is to correct, undo, or otherwise reverse and adjust an entry made during the previous accounting period. Reverse entries enable companies to account for expenses in the correct accounting period without having to worry that they recorded the expense twice.

Summary

So, what is a journal entry? A journal entry is a record of any transaction performed by a business, including the buying and selling of goods and services, company payroll, interest payments and commission, marketing costs, asset sales and depreciation, and much more.

But most importantly, journal entries are the foundation on which a company’s financial integrity rests. Accurate and timely journal entries enable accurate budgeting as well as the production of reliable financial statements that will be used by investors to gauge a company’s performance.

Automating your journal entry processes can reduce preparation time, mitigate risk with stronger governance, and increase visibility for easier audits. Find out more about how automation software can help your team achieve its goals.

Learn more in our Finance & Accounting Glossary