Making Non-Trade Intercompany Accounting a Non-Problem

Blog post

Share

How preventative controls can make your non-trade intercompany reconciliation process predictable, reliable, and dependable.

Within intercompany accounting, there are two types of transactions, trade and non-trade, also known as product and non-product. For today, we’ll focus on non-trade and look at how preventative controls can help you manage the process from the initial invoice all the way through discrepancy management.

As an example, let’s say that a transaction takes place between two subsidiaries of Swiss Choc AG, a company headquartered in Switzerland that manufactures chocolate bars. Almonds Inc. is located in California and supplies the Swiss manufacturing entity with the almonds that are used in the final product. The company has preventative controls in place to manage transactions between the entities so that when there’s a shared cost, such as an inspection of an upcoming shipment by a visiting Almond expert from the US, there’s a set process for how invoices are generated, approved and processed between the two parties.

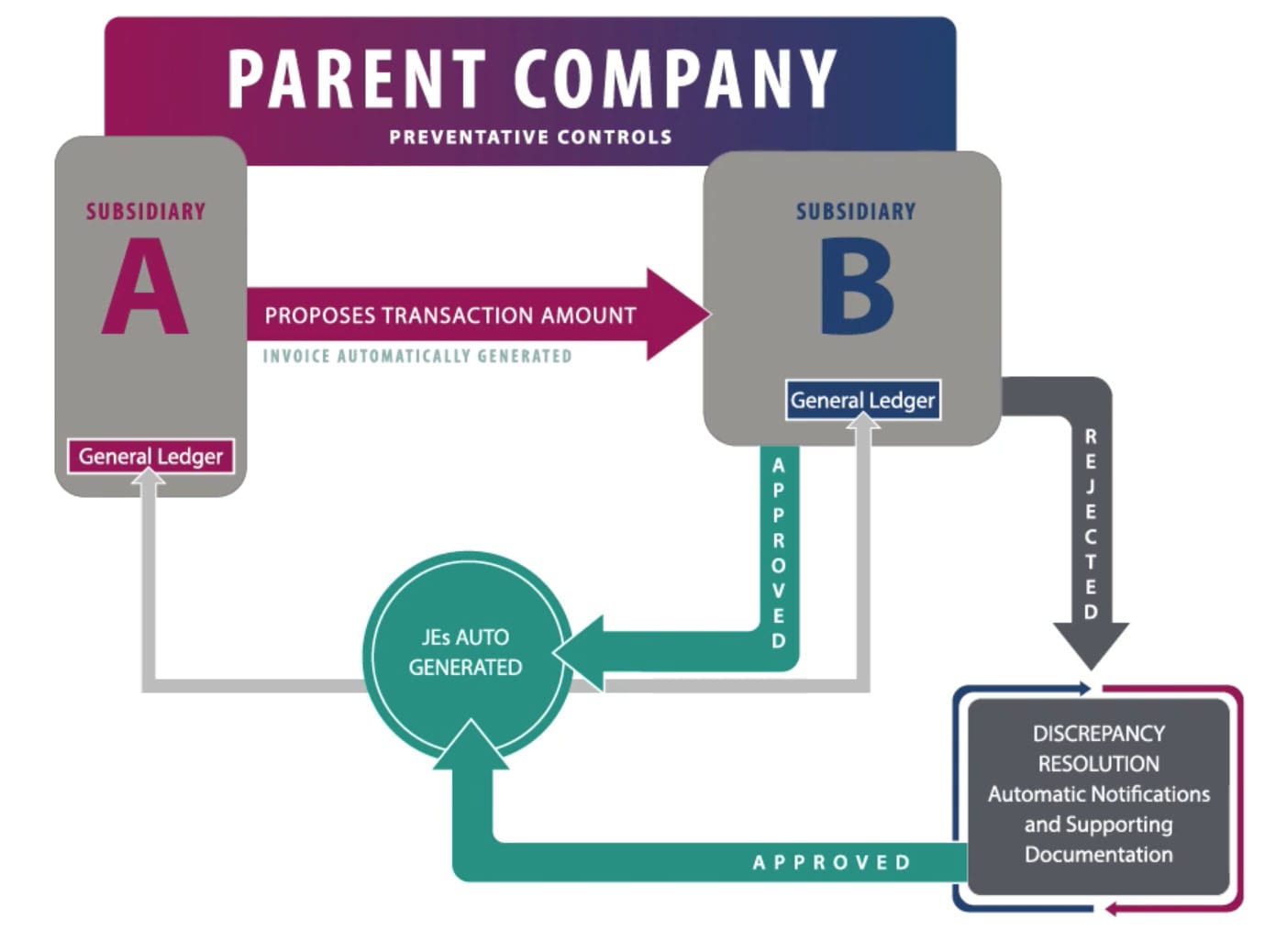

Now, when Almonds Inc., invoices the manufacturer for their share of the expert’s cost, preventative controls help manage the process right from when the transaction is proposed and the Swiss entity is automatically notified. If it’s approved, journal entries are then automatically posted into each entity’s ERP. At this point, an invoice may be generated to support the transaction. However, in the event of a discrepancy, such as entering the incorrect hourly rate for the expert’s time, pre-defined processes ensure that the right people are notified of the issue and facilitate the submission of supporting documentation until an agreement is reached. Upon agreement, the journal entries are generated and posted to each company’s respective ERP.

Now, when Almonds Inc., invoices the manufacturer for their share of the expert’s cost, preventative controls help manage the process right from when the transaction is proposed and the Swiss entity is automatically notified. If it’s approved, journal entries are then automatically posted into each entity’s ERP. At this point, an invoice may be generated to support the transaction. However, in the event of a discrepancy, such as entering the incorrect hourly rate for the expert’s time, pre-defined processes ensure that the right people are notified of the issue and facilitate the submission of supporting documentation until an agreement is reached. Upon agreement, the journal entries are generated and posted to each company’s respective ERP.

By automating the intercompany accounting process and enhancing preventative controls over journal entries and invoice creation, both subsidiaries can now easily work within a controlled environment and ensure that discrepancies for non-trade transactions are quickly resolved, and all necessary supporting documentation, such as contracts and invoices, is attached for easy reporting and compliance. Organizations who have strong preventative controls involved in the intercompany process are able to ensure there is a robust and error-free process for invoicing between the two parties prior to the recognition of financial transactions. This ultimately offers clear visibility into the intercompany process to ensure that all discrepancies are resolved before period end.

To discover additional ways to create a best-in-class intercompany accounting process, check out our video, “How to Make Intercompany Accounting Predictable and Reliable.”

The Complete Series:

Making Non-Trade Intercompany Accounting a Non-Problem

Intercompany Accounting Series 1 of 3

Detecting the Discrepancies in Your Trade Transactions

Intercompany Accounting Series 2 of 3

Period End Reconciliation — Intercompany Accounting’s End Game

Intercompany Accounting Series 3 of 3

Written by: Caleb Walter