How Cost-Cutting Strategies within the Upstream Oil and Gas Industry Can Spell Disaster for their Office of Finance

Blog post

Share

The upstream oil and gas industry has always held a certain level of uncertainty within its revenue stream. Like early wildcatters drilling exploratory oil wells in the hopes of striking it rich, today’s upstream industry can often struggle to remain profitable in the face of issues beyond their control.

Issues such as:

- Advances in non-fossil fuel sources

- Government regulation and geopolitics

- Over or under-supplied markets leading to fluctuating crude oil prices

- An approximate 4% drop in primary energy consumption since 2007

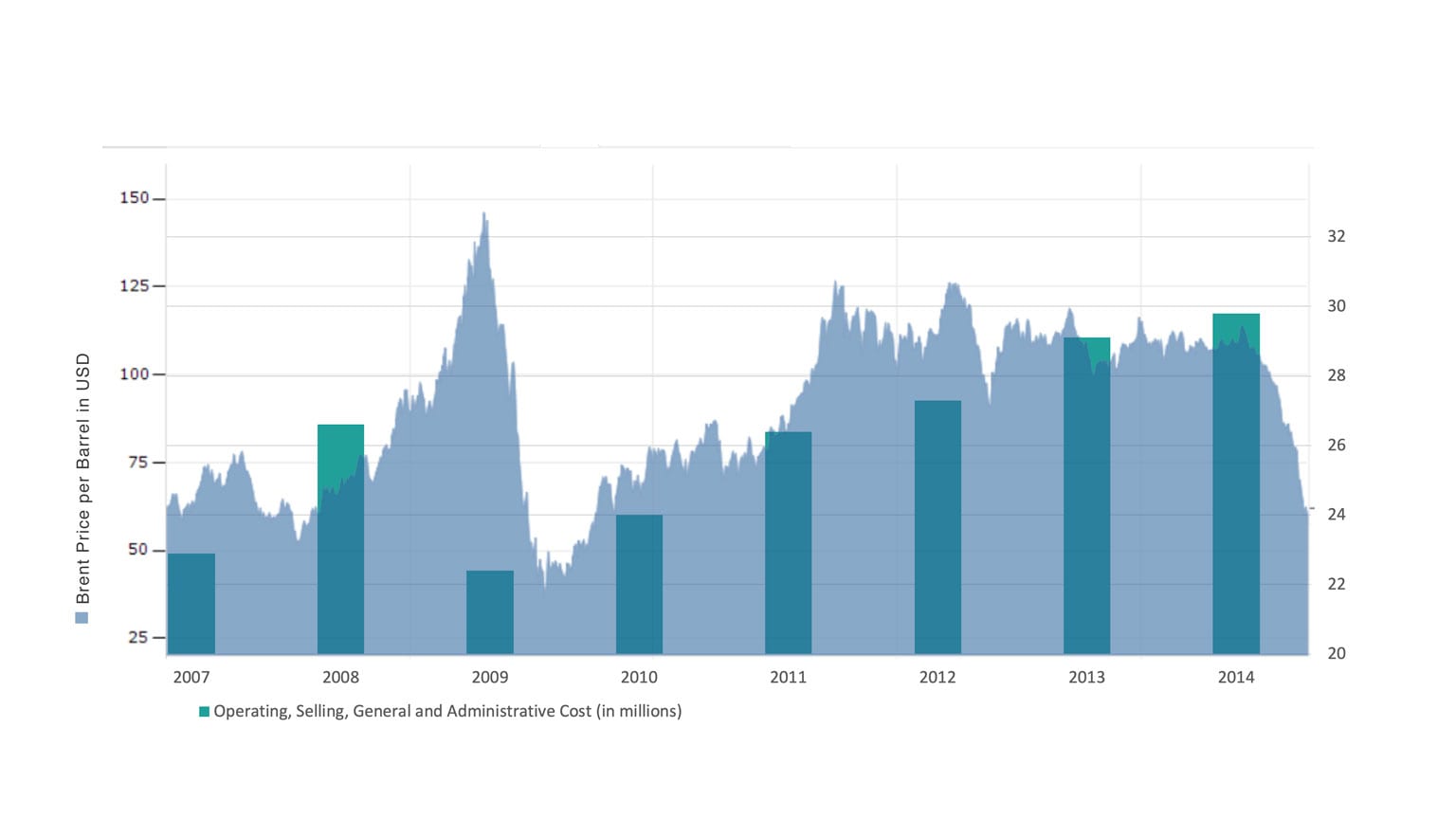

have forced upstream oil and gas companies to adopt cost-cutting strategies that make them as lean as possible. Producers have cut costs aggressively, lowering overall operating expenses by up to 3 dollars per barrel, trimming global headcount by 20% to 30% and reducing capital expenditures by about 60% from the previous year’s peak levels.

Why Is That an Issue?

Sadly, when organizations decide to trim their budget, the cutbacks are typically not evenly distributed. Cost-cutting methods within this industry have historically focused on non-revenue generating and support functions within the companies, such as the office of finance.

Despite the reduction in resources, many offices of finance make no adjustments or only minimal changes to how they approach their financial close process.

Instead, organizations introduce a new level of risk by adopting a “do more with less” mindset without any change to how the process is conducted. Ultimately, this approach requires longer hours and later nights to produce financial statements – the product of which is often unreliable.

Even the best organizations will admit to at least some occasional hiccups within their current processes. However, there is no organization that can afford to remove necessary resources by “doing more with less” and not expect those “occasional hiccups” to worsen if no change is made to the structure of the process itself. And any issues with the current processes that might have once meant being solved with extra time spent manually verifying the financials now leads to million in fines and reduced consumer confidence due to misstatements.

To make matters worse, the additional risk isn’t a guarantee of long-term cost savings.

Following massive cost-cutting between 2008 and 2009, one upstream organization saw its general and administrative expenses grow to almost identical levels within four years – despite crude Oil prices staying stagnant and eventually declining.

Where Does the Industry Go from Here?

With demand for oil expected to peak as early as 2035, cost-cutting measures will likely be necessary now as well as in the future. However, while organizations within this industry must be able to adapt when necessary, it’s important that the solution is both permanent and doesn’t compromise the integrity of their financials.

Financial automation not only offers the cost-reduction that the industry values so highly but does so while providing the visibility and resources that your accountants need in order to provide accurate and timely financial statements.

Unfortunately, it can be difficult to find time to make such a fundamental change when the market fluctuates as often as this one does. However, the current approach of temporarily cutting costs by “doing more with less” isn’t a sustainable approach and organizations need to be willing to change as the market their operating in does.

To learn more about how to make that fundamental change, download our eBook “5 Best Practices to Modernizing Your Month-End Close.”

Explore the Entire Series