How to Save Hundreds of Hours a Year Automating Intercompany Invoicing using Cadency and SAP®

Blog post

Share

The majority of large organizations undertake substantial intercompany activities in the form of goods and services exchange as they conduct their business. One of the essential finance and accounting activities is to conduct intercompany invoicing and reconciliations on a periodic basis so that period-end closing and reporting can be done accurately and timely. Moreover, to reduce exposure to currency exchange risks, organizations utilize several approaches to try to move to regular settlement of intercompany invoices. Nevertheless, most of them rely on the native functionality within their ERP system such as SAP®, ECC6, BPC, S/4HANA, etc. with varying degree of customization and manual efforts.

Typically, companies have in-house finance and accounting (F&A) teams or rely on shared service centers to manage the intercompany billing process. Team members can easily spend hundreds of hours of manual effort every year to manage this process for all the legal entities across the company.

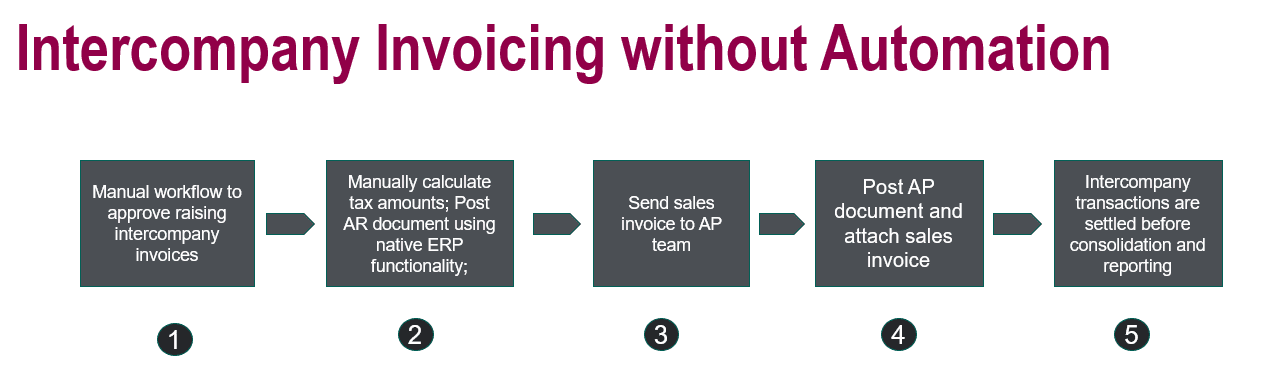

The below diagram depicts the typical manual steps involved in this process:

- Initiate manual workflow to approve raising intercompany invoice by receiving entity, usually via email (3-5 manual steps)

- Use native functionality within SAP® ECC6 or S/4HANA to post Accounts Receivable (raising the sales invoice), document individually or using a batch process & print the sales invoice; Tax amounts are manually calculated using bespoke processes and tools (5-10 manual steps)

- Forward the sales invoice to the Accounts Payable (AP) team for posting the invoice into the receiving entity (1-2 manual steps)

- Receiving entity post the sales invoice as an AP document and attaches the sales invoice

(3-5 manual steps) - Before consolidation and reporting, intercompany transaction amounts are settled either via netting or cash payment for accurate reporting (1-5 manual steps)

As you can see, this manual approach is tedious and not only increases the time and cost of completing the intercompany invoicing but also significantly increases the risk of errors potentially requiring rework.

Some of the commonly encountered issues in the process include:

- Delay in posting of documents due to manual workflow

- Mismatches due to delay in posting both sides of transactions

- Potential error in allocating correct withholding tax resulting in local fines

- Increased exchange gains & losses due to delay between raising & settlement of invoices

- Manual process resulting in high “cost to serve” for Intercompany transactions

By automating this process with Cadency, organizations can streamline their intercompany invoicing process saving massive manual efforts and/or expensive customization within the ERP. This not only reduces cost and risk but increases the efficiency and effectiveness of the overall close process.

Now, you may wonder why you should invest in another solution when you have already made investments in ERP such SAP® ECC6 or S/4HANA, other vendor tools and plethora of home-grown custom solution. ERPs are great at what they were created for but do not provide the automation or controls needed for effective and efficient record-to-report (R2R) processes. Other vendors do not provide a fully integrated R2R platform with cutting edge native ERP automation like Trintech does. You can try to piecemeal a solution to accomplish the same functionality using other vendor tools, custom developments etc. but that takes you back to square one with increased cost and risk with disjointed and error prone process.

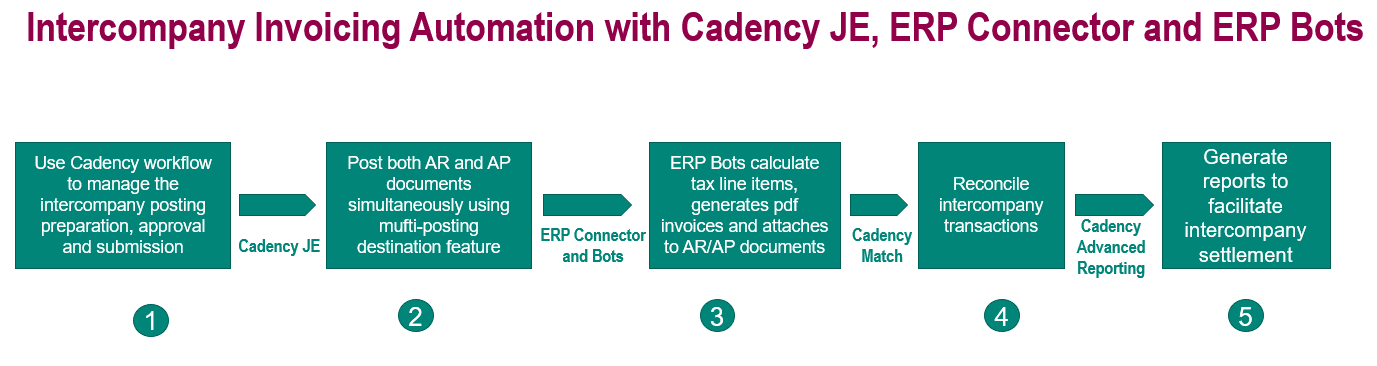

So, let’s look at that intercompany invoicing example again, but this time using automation. Cadency provides a seamless and comprehensive solution within its Journal Entry process to eliminate manual steps and use of non-standardized tools such as spreadsheets, emails and custom tools completely. With Cadency, customers can:

- Manage the intercompany posting preparation, approval and submission enabling traceability and auditability (no manual steps)

- Post Intercompany Journal Entry consisting of both AR and AP documents in real time using Cadency’s JE connector via its multi-posting destination feature (no manual steps)

- Utilize ERP Bots to automatically calculate the tax line items, generate the PDF invoice and attach to the posted document in SAP® ECC or SAP S/4HANA (no manual steps)

- Reconcile intercompany transactions seamlessly using Cadency Match (no manual steps)

- Generate reports to facilitate intercompany settlement using advanced reporting capabilities in Cadency (1-5 manual steps)

This is what the automated intercompany invoicing process looks like after implementing Cadency. It saves our customers up to 20 manual steps which across thousands of intercompany transactions can lead to hundreds of hours of time savings.

As you can see, Cadency unifies all the workflow in one place resulting in a simplified and standardized intercompany process with end-to-end traceability and auditability. This leads to timely posting of both AR/AP documents, eliminates mismatches and errors, reduces exchange rate risks and reduces overall cost to serve while greatly improving the efficiency and effectiveness of overall close process.

For more information on how Cadency can transform your Office of Finance, contact us.

Written by: Mantosh Kumar

Additional Resources: