How Cadency’s System of Automation Improves your Record to Report Process

Blog post

Share

Over the past few years, Robotic Process Automation (RPA) has started to gain traction in the office of finance. While, technically speaking, there is a very baseline version of automation within spreadsheets, the efficiency gains that come with more advanced automation are finally making their way into companies’ finance functions.

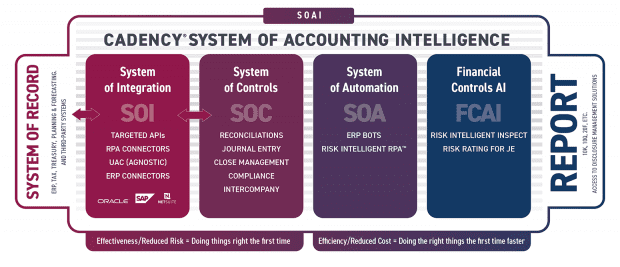

So, what is RPA? How does it affect the financial close process? How are other companies currently utilizing RPA to transform their financial close? Basic RPA automates repetitive manual tasks. However, although a basic RPA approach can increase the efficiency of the process, it does not ensure the effectiveness of the financial close process. There are many companies in the market-defining RPA as automating for simplicity and expediency. In our experience, taking a flawed process and making it run faster leads to even greater problems for any organization than before deploying RPA. What is needed to drive strategic change is an approach that not only increases efficiencies but also enforces compliance and control to ensure the integrity of the period end numbers. That is why it is so important to look at a System of Automation in the context of the overall System of Accounting Intelligence framework laid out below that encompasses the complete Record to Report process.

Once an organization has established a System of Controls and put in place a System of Integration to allow the System of Controls to seamlessly share data back and forth with the System of Record, thus ensuring that things are done right the first time and in the most effective manner, THEN they can begin properly implementing a System of Automation. Within this blog, we will discuss how Cadency’s System of Automation, and the parts that make it up, benefit the office of finance.

Risk Intelligent RPA™

From determining the resources applied to an event or issue to guiding recommendations made to the overall organization, at Trintech, we operate under the firm belief that risk should inform everything the office of finance does. For this reason, Trintech created Risk Intelligent RPA which takes robotic process automation to the next level by configuring automated workflows based on your business’ risk tolerance. With this in place, accountants can focus their time on the truly high-risk items and more value-added work. This approach improves upon RPA by not just allowing an organization to perform their work faster, but also enhancing the quality of the work performed. In this way, we create an impact of reduced risk while enabling reduced cost to the process as well.

Within the Record to Report context, we help companies identify risks and automate processes through Risk Intelligent Robotic Process Automation™ (RI RPA). This technology allows them to focus on areas that represent a higher risk to the organization when it comes to creating confidence in their financial reporting.

Risk Intelligent RPA sits inside of Cadency and is assigned a risk profile (through input from the business on how they want that to be measured). That risk profile is then used within an organization’s reconciliations, journal entries, close checklists and controls testing to decide both HOW to do something and WHETHER to do something. For example, if a business is going through a testing cycle in Q2 and they want to only focus on April and May, they can save time on the additional work of doing the April & May Reconciliations by running Risk Intelligent RPA to skip low and medium risk accounts. Additionally, risk thresholds can be set in order to alert users of substantial changes within those low and medium risk accounts such as a balance change greater than $100,000 USD or greater than a 5% change. This ensures time savings overall and provides visibility to any risk areas that require human attention.

ERP Bots

Similar to how a System of Integration enables your System of Controls and System of Record to communicate, ERP bots enable automation within your IT environment. Recently certified by SAP, Cadency’s ERP bots drive the financial close workflow into the ERP and other systems. This enables both a faster close and reduces overall risk by removing previously necessary human intervention.

Automation in Action: Real-Life Examples

HP has transformed its financial close by flipping the process on its head. After realizing 93% of the balance sheet accounts, which only accounted for 6% of the balance sheet, was where they spent most of their time, HP implemented RI RPA to help reallocate their work. With RI RPA, they moved from applying effort everywhere to only focusing on the 7% of balance sheet accounts that exposed the organization to the most risk. RI RPA was the key to this transformation as it utilizes the customers’ compliance and risk profile to identify the work which requires human engagement and automates that which can be based on their risk/compliance profile.

Another example is Sanofi, who was able to implement automation in the closing calendar to replace manual processes. This transition increased the visibility for upper-level management on the account reconciliation validation flow and journal entry process. Additionally, Sanofi saw improved productivity for more than 2,300 users and increased compliance for more than 2,505 accounts.

System of Accounting Intelligence

Cadency’s System of Accounting Intelligence combines ground-breaking automation technologies, such as Artificial Intelligence (AI), Robotic Process Automation (RPA) and Bots, and applies them throughout or around Cadency’s System of Controls (SOC) to support the often complex and complicated Record to Report process. These technologies offer unique, powerful solutions to some of the most complex R2R challenges and readily scale as the financial transformation journey evolves and businesses grow.

To learn more about how the Cadency System of Accounting Intelligence can benefit your organization, check out our webinar.

Explore the Full Series on Cadency’s System of Accounting Intelligence

Part 1 – SOR, SOI and SOC

Part 3 – Financial Controls AI