The Case For Digital Transformation In The Power and Utilities Industry

Blog post

Share

Amid changes due to COVID-19, power and utility companies were relied on to be the grounding force for many industries. For example, healthcare organizations functioned as the care centers for COVID-19 patients, while battling the significant spike in cases. Behind the scenes of healthcare “superheroes” were the power and utility organizations working from their homes— or from in-office environments when virtual work wasn’t possible— to keep the lights and power running for hospitals, healthcare centers and more.

Not only that, but the pandemic forced most companies to send their employees home to continue work virtually, resulting in an increased need to provide uninterrupted power to residential homes on a larger scale than before. Just like in any crisis, the demand on power and utility companies surged, and these organizations had to figure out how to balance that demand with changing regulatory standards such as providing relief for customers that were significantly impacted by the pandemic.

Not only that, but the pandemic forced most companies to send their employees home to continue work virtually, resulting in an increased need to provide uninterrupted power to residential homes on a larger scale than before. Just like in any crisis, the demand on power and utility companies surged, and these organizations had to figure out how to balance that demand with changing regulatory standards such as providing relief for customers that were significantly impacted by the pandemic.

The pandemic revealed that the power and utilities sector has a unique opportunity to become more innovative and customer-centric, especially across their finance and accounting departments.

Shifts in Power and Utilities Sector

A recent KPMG webinar featured a discussion between panelists from power and utility companies talking about the new trends COVID-19 spurred in the industry. They all agreed that while power and utilities organizations have traditionally been classified as “old school”, the pandemic has presented the sector with more opportunities to think innovatively.

Opportunities COVID-19 Created For Power and Utilities Sector

- Empowering residential customers

- Enabling a more resilient commercial and industrial sector

- Pioneering new ways of working with regulators

C ustomer centricity was a factor that all the panelists in the webinar emphasized as significantly important for these organizations to progress towards. As seen throughout the pandemic, power and utilities are expected to provide next-level reliability for both residential and commercial customers. This includes helping customers resolve payment issues and allowing customers to be able to run their lives from their homes.

ustomer centricity was a factor that all the panelists in the webinar emphasized as significantly important for these organizations to progress towards. As seen throughout the pandemic, power and utilities are expected to provide next-level reliability for both residential and commercial customers. This includes helping customers resolve payment issues and allowing customers to be able to run their lives from their homes.

KPMG highlighted the unique opportunity for power and utilities companies to shift from “old school” to “uber-essential”.

In the KPMG webinar, Scott Crider, Chief Customer Officer of San Diego Gas & Electric, offered a few examples of how their company has proactively identified opportunities to go above-and-beyond for their customers. One example centered around the wildfires in California and creating “high-touch” environments for their customers, which includes deploying new customer applications, providing wildfire preparedness education and sending employees to individual homes if needed.

The panelists admitted that though power and utility organizations have made significant strides in the last few decades to become more customer-centric, there are still many opportunities to provide better customer experiences and increase customer trust and loyalty.

One panelist explained how her company was able to provide relief in the face of COVID-19 for their customers:

“When COVID hit for us in March with the force that it did, we were one of the first utilities across the board to voluntarily suspend the disconnection of our customers for non-payment as well as reconnect those customers who had been disconnected previously, recognizing the importance in how essential the service of electricity is for those customers…” –Bridget Reidy, Executive Vice President and Chief Operating Officer, Exelon Corporation

Digital Transformation of Current Back-End Processes

The power and utilities industry can only successfully become more customer-centric once they have optimized back-end processes. Namely addressing the “old school” processes within their Office of Finance.

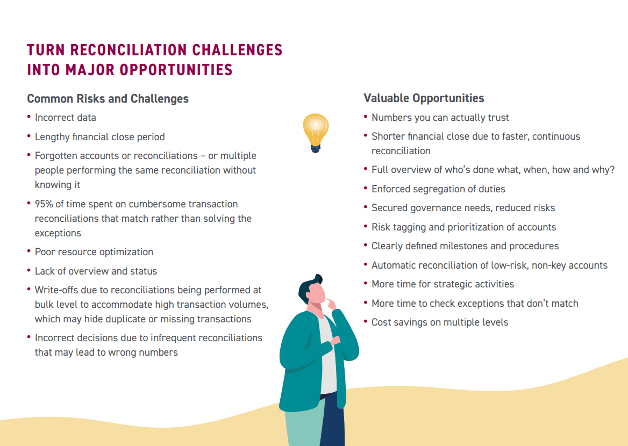

Like many other organizations, power and utilities companies tend to utilize spreadsheets and manual processes to complete and manage their financial close process. But this approach to the financial close causes many issues, such as:

- Workflow bottlenecks throughout the close

- Increased risk of non-compliant reporting

- Lack of control and visibility

- No capabilities for advanced data analytics

- Inability to complete a virtual close

To better serve customers, organizations within the power and utilities sector need to invest in digital transformation initiatives for their Office of Finance. Financial automation helps organizations with shortening the time to close, reducing close costs, increasing control and visibility and providing advanced analytics. Spreadsheets alone don’t provide the level of efficiency, effectiveness and insight that is needed in the financial reporting to allow companies to focus on customer-centric initiatives.

To better serve customers, organizations within the power and utilities sector need to invest in digital transformation initiatives for their Office of Finance. Financial automation helps organizations with shortening the time to close, reducing close costs, increasing control and visibility and providing advanced analytics. Spreadsheets alone don’t provide the level of efficiency, effectiveness and insight that is needed in the financial reporting to allow companies to focus on customer-centric initiatives.

Digital transformation for finance and accounting will help strengthen power and utilities companies to take advantage of the opportunities COVID-19 has presented. Organizations that optimize their financial processes with Cadency by Trintech experience:

- Significant time savings in the Record to Report processes

- Decreased costs due to misstatements, write-offs and cash shortages

- Improved visibility and controls in the form of management reports, controls testing, internal audits and more

Learn more about how digital transformation can help organizations equip their finance teams to deliver more results with their existing resources.

Written by: Ashton Mathai