How Trintech Goes Beyond RPA to Automate Your Journal Entry Process with Cadency Smart Bots

Blog post

Share

As leading organizations continue their Record to Report transformation journeys as a part of their overarching digital transformation strategies, one of the most popular automation technologies that has been adopted is Robotic Process Automation (RPA). Now, organizations that have embraced RPA are discovering that a single, task-based automation tool isn’t enough to implement efficient, resilient, and holistic digital business processes. To gain the full value of automation, organizations are now looking beyond RPA to what Gartner calls “hyper-automation”, a disciplined approach to rapidly identify, vet and automate as many business and IT processes as possible through the orchestrated use of multiple technologies, tools or platforms. This new term from Gartner aligns closely with Trintech’s recent rollout of Cadency Smart Bots.

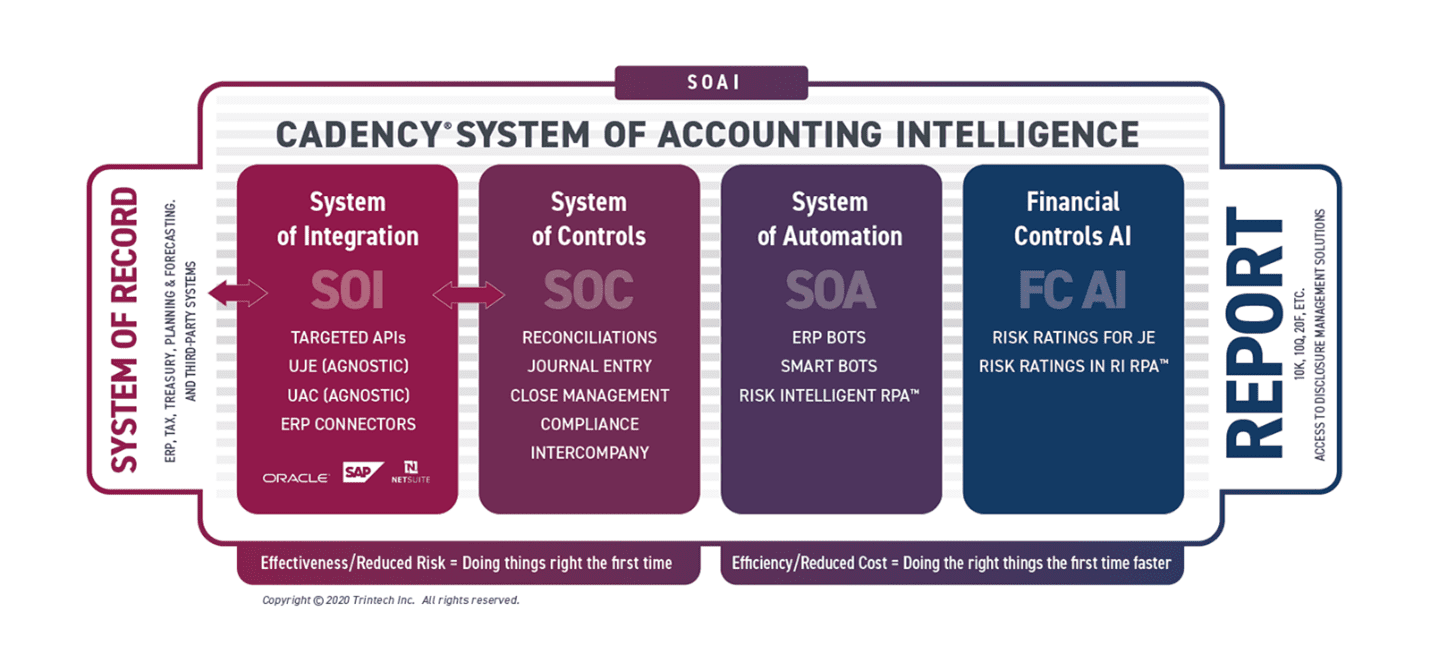

Trintech already provides a comprehensive System of Accounting Intelligence™ (SOAI) that standardizes and automates your full Record to Report process and leverages leading technologies such as Risk Intelligent RPA (RI RPA) capabilities for Dynamic Approval Routing and Dynamic Account Maintenance. With the introduction of Cadency Smart Bots in our System of Automation within our System of Accounting Intelligence, our customers can now benefit from additional automation offerings that allow not only the automation of repetitive manual tasks but also complete Record to Report (R2R) use cases while using Cadency as your System of Controls. It uses proprietary technology and native Cadency integrations and includes a variety of use cases that are continually expanding, based on market needs, to automate various R2R processes.

In this blog, I will use a Journal Entry automation example to illustrate how Cadency’s automation and integration offerings continue to increase efficiencies for our customers.

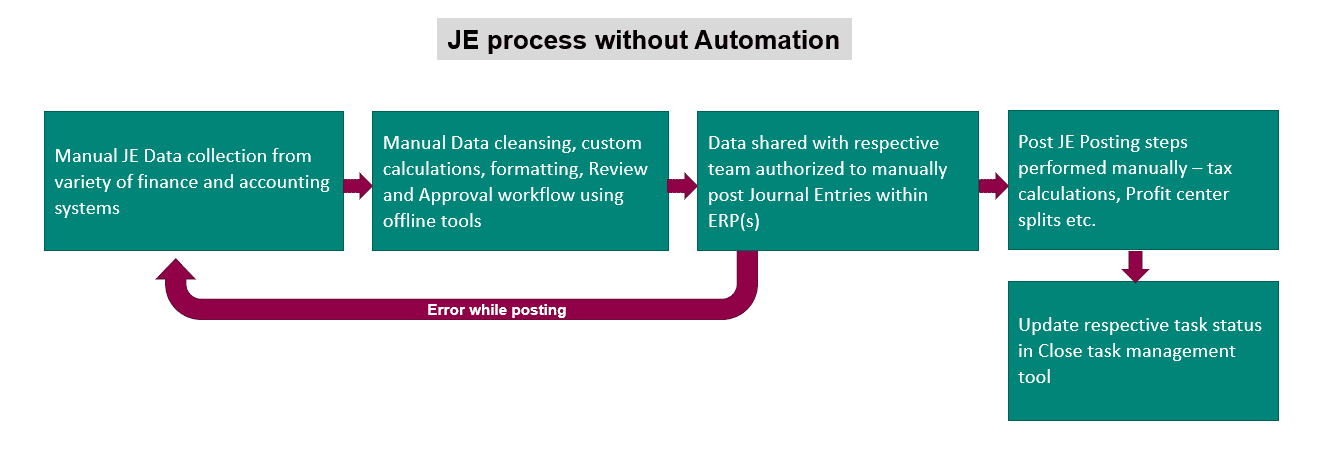

A typical large enterprise could be posting thousands of manual Journal Entries as part of their period-end close process, leading to a very time-consuming process for finance and accounting professionals. Not only does this process take a significant amount of time to create and to ensure accuracy, but internal approval processes and strict deadlines can often significantly slow things down, even when the risk is low. The typical process may look something like this:

- Necessary Journal Entry data and associated backup documentation is manually collected from a variety of finance and accounting systems such as payroll inventory management, treasury, etc.

- The data then goes through a complex set of one or more manual hand-offs to prepare the data, correct various entries, perform additional calculations, and format using pre-defined templates

- It then goes through a series of back-and-forth communication to get approvals using some workflows or, in many cases, just emails or phone calls

Once approved, it is then sent over to the respective teams who are authorized to manually post the Journal Entries to the System(s) of Record or ERPs - If there are any errors, multiple teams need to get involved to investigate the root cause, fix the errors, and go through the above steps again

- Once Journal Entries are posted, there are dependent activities to run reports within ERP systems and perform multiple other steps such as tax allocations and profit center splits. This may require performing additional calculations and text analysis and reporting to other teams

- Finally, the associated Close Tasks need to be updated to reflect the status of the postings

It is important to note that all of these steps listed above must happen within a matter of days during the period-end close and is repeated every month.

Now, you can only imagine what happens to the teams involved in this highly manual and inefficient process and the resulting impact on the overall period-end close:

- Teams dread this process which is often fraught with errors and may require rework in most cases

- Leadership has low confidence on the final set of numbers due to many manual hand-offs and non-standardized processes

- Internal and external auditors find it very hard to track the end-to-end data and the various substantiation documents

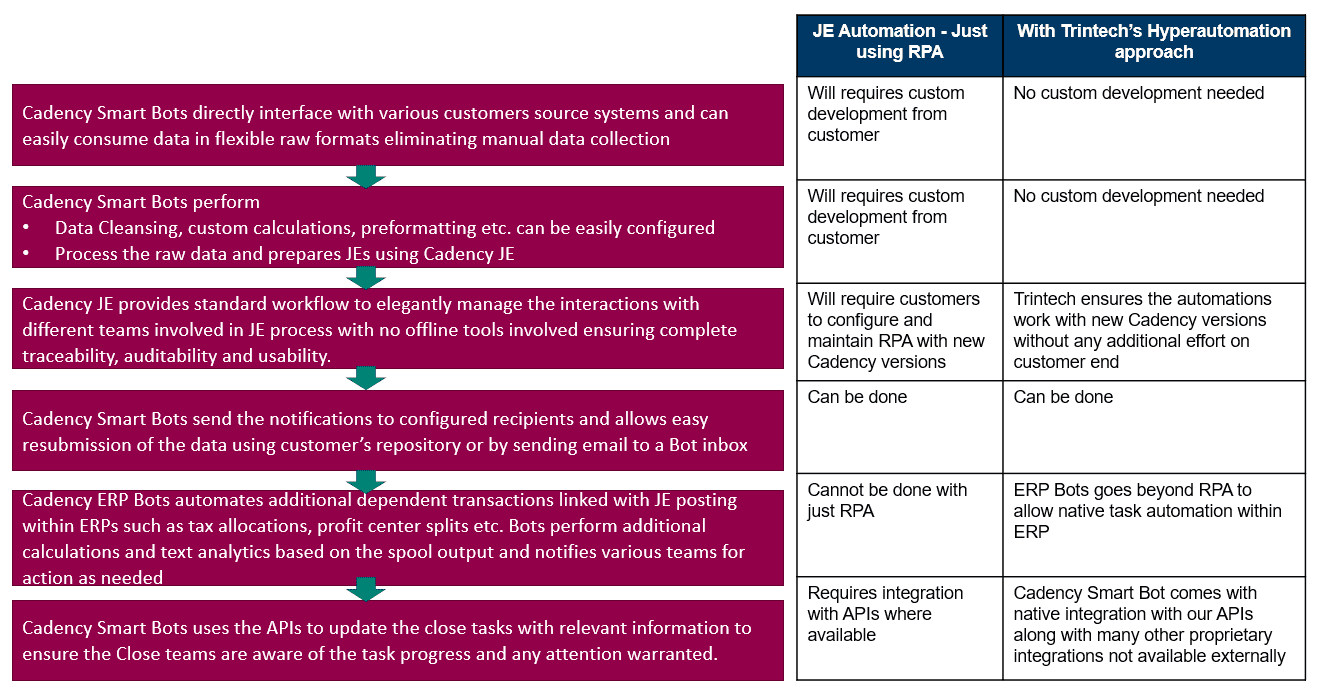

The entire Journal Entry posting process can be made more efficient with reduced risk by using our Cadency Smart Bots. The optimized process will look something like this:

As you can see, the automation approach from Trintech goes beyond just RPA. Instead, it is a combination of technologies (hyper-automation) that are leveraged for a more robust and deeper automation that is not possible with just one tool. With the addition of Cadency Smart Bots, Trintech offers best-of-breed automation that is unique in the financial close solution space. It provides significant benefits to our customers, reducing cost and risk and accelerating the close activities for a smoother period-end and a seamless close experience.

To help finance organizations become more strategic to their business, Trintech is continually focused on providing solutions that improve efficiency and effectiveness while reducing the cost and risk across all aspects of the Record to Report process. Our customers can amplify their automation and financial transformation efforts within their Office of Finance by using a multi-pronged hyper-automation approach, leveraging Cadency as their System of Accounting Intelligence.

Stay tuned for additional blogs on many more R2R automation use cases!

Written by: Mantosh Kumar, Technical Product Manager at Trintech