From manufacturing to aerospace, automation has affected every industry globally. However, though automation is becoming increasingly more prevalent, when a company begins implementation, it’s not typically done throughout the entirety of the organization. The office of finance, in particular, has lagged behind other business units when it comes to utilizing new technology in order to streamline and improve their day-to-day tasks. But recently, organizations have seen an uptake in the implementation of automation in finance and accounting departments.

Over the past few decades, F&A professionals have been moving away from the spreadsheets and manual-processing methods that they have relied on since the ‘80s, and towards automation. The results of this shift speak for themselves.

Below are four compelling reasons the office of finance has begun moving away from spreadsheets and manual methods and looking to implement automation.

1. Cost-Cutting Measures

Historically, when costs need to be cut, the office of finance is one of the first places that is hit. Instead of being given the resources and staff to properly close the books, these cost-cutting measures force accounting teams to adopt a “do more with less” mindset. And typically, this translates into already-stretched-thin teams working late nights and weekends.

Historically, when costs need to be cut, the office of finance is one of the first places that is hit. Instead of being given the resources and staff to properly close the books, these cost-cutting measures force accounting teams to adopt a “do more with less” mindset. And typically, this translates into already-stretched-thin teams working late nights and weekends.

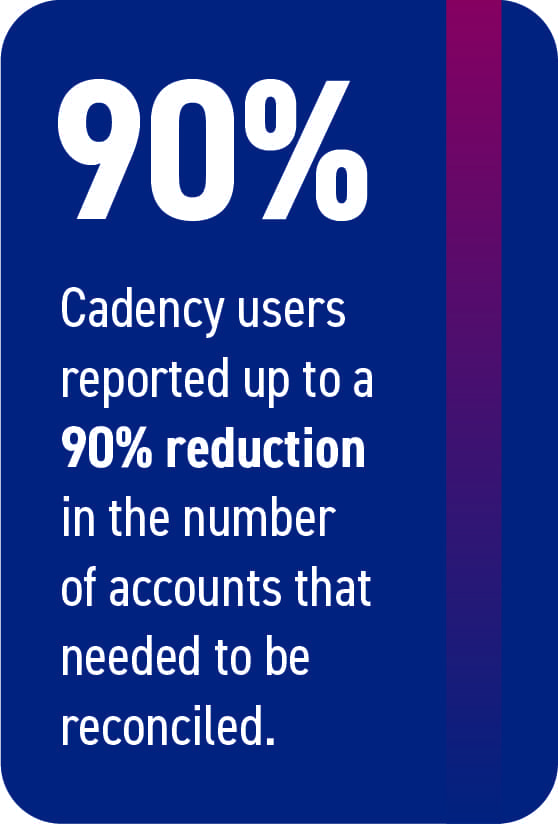

Sometimes, cost-cutting is inevitable, but the solution isn’t to overwork your existing staff, it’s to make sure their time is being better spent. Finance and accounting organizations that implemented automation through Cadency have seen up to a 90% reduction in the number of accounts that need to be reconciled. An accountant who once spent their day managing their close task list or reconciling accounts can now take care of those things with an automated solution. Working alongside automation, accountants’ time is better spent on higher-value tasks such as data analytics and forecasting.

Additionally, overworking your team negatively impacts the morale of your employees, leading to an increased turnover rate and the loss of important internal knowledge of how the close process is conducted. Fortunately, organizations that have chosen to implement Cadency are seeing an up to 10% reduction in employee turnover.

These results show that you can quickly future-proof your office of finance with a proven solution that is sustainable and adaptable to the organization’s needs.

2. Increase in Regulatory Rules and Crack Downs

No matter your industry, it’s very likely that the amount of regulations put in place— by either governmental bodies or internal sources — grows year-after-year. Additionally, regulatory bodies around the world have begun cracking down more heavily on existing regulation. For example, between 2017-2018, the FCA issued 50% more final notices year-over-year and the duration of cases that settle has increased by 49%.

No matter your industry, it’s very likely that the amount of regulations put in place— by either governmental bodies or internal sources — grows year-after-year. Additionally, regulatory bodies around the world have begun cracking down more heavily on existing regulation. For example, between 2017-2018, the FCA issued 50% more final notices year-over-year and the duration of cases that settle has increased by 49%.

As time goes on, both of these trends will likely increase, and the need for the office of finance to remain compliant will grow in tandem. But keeping up with this increased regulation is difficult with manual processes. For some organizations, the only way to keep track of new regulations put in place is by manually searching through a government database and cross-referencing your work with the latest regulatory guidance. Not only is this approach inefficient, but the chances of missing a regulation that leads to issuing a misstatement are high.

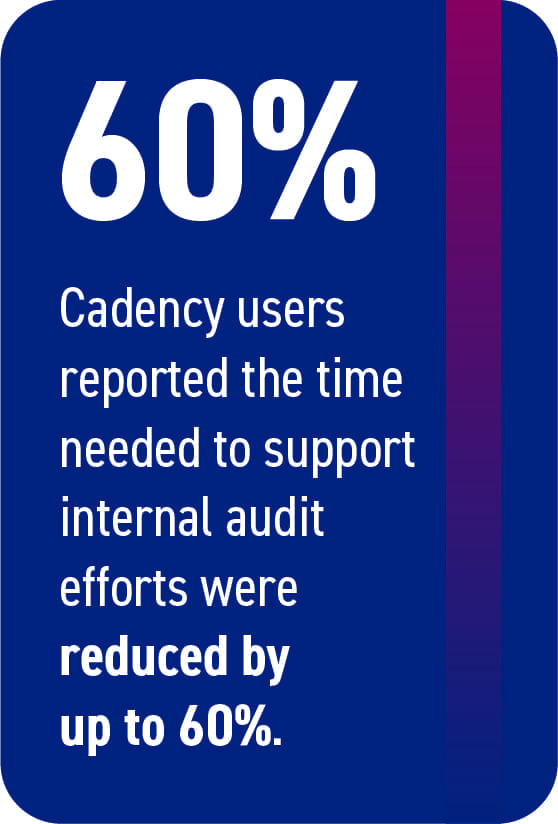

To overcome this, organizations spend vast amounts of money on internal and external audit efforts. However, the process of pulling supporting documentation to support those audits is also time-consuming and, in a study of Trintech customers, was repeatedly reported as a recurring time commitment for their internal accountants.

But after implementing Cadency, organizations found that the time needed to support internal audit efforts was reduced by up to 60%. With Cadency in place, your transaction changes, supporting information, and more are tracked in a detailed audit trail and directly associated with each transaction.

3. Organizational Growth

It seems like every year there is a new record for the number of corporate consolidations through mergers and acquisitions (M&A). But 70% of M&A end in failure, and a third of companies surveyed in a recent study by IMAA stated that the integration of financial processes and reporting is the greatest challenge during acquisitions.

It seems like every year there is a new record for the number of corporate consolidations through mergers and acquisitions (M&A). But 70% of M&A end in failure, and a third of companies surveyed in a recent study by IMAA stated that the integration of financial processes and reporting is the greatest challenge during acquisitions.

Primarily, this difficulty stems from the fact that spreadsheets and manual processes are hard to scale. Whether it’s through M&A or natural growth, spreadsheets were originally designed to balance the budget of a typical four-person family. And when this tool is applied to a growing organization, it quickly becomes a confusing mess of numbers that makes drilling down into the details of the organization’s financials almost impossible. Because of this, mistakes are made and events such as misstatements or write-offs become a highly likely possibility.

Primarily, this difficulty stems from the fact that spreadsheets and manual processes are hard to scale. Whether it’s through M&A or natural growth, spreadsheets were originally designed to balance the budget of a typical four-person family. And when this tool is applied to a growing organization, it quickly becomes a confusing mess of numbers that makes drilling down into the details of the organization’s financials almost impossible. Because of this, mistakes are made and events such as misstatements or write-offs become a highly likely possibility.

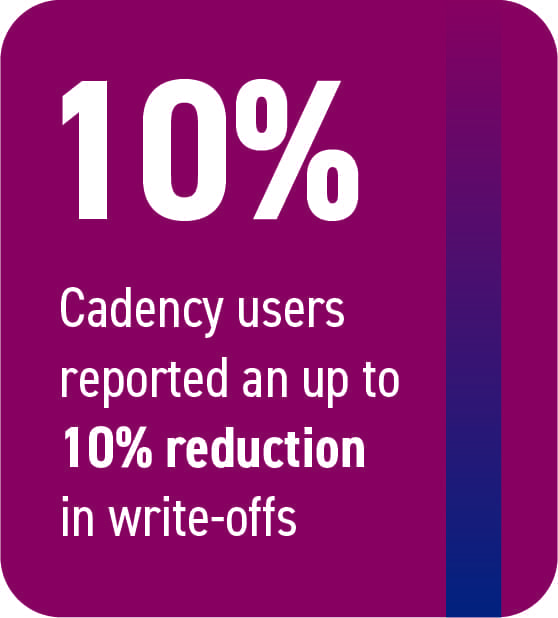

To overcome this, organizations are implementing automation in finance and accounting departments before— or even during— their M&A activities. And, with the support of Cadency, organizations found an up to 10% reduction in write-offs in addition to easy access to supporting documentation to understand and resolve their discrepancies.

4. The Need for Insight

Even before the current crisis began to impact daily business activities, the roles of the office of finance and the CFO was changing. While typically regarded as “number crunchers”, the role of the accountant has evolved into a figure who is leaned on for valuable insight that can drive business strategy based on the financial information they present.

Even before the current crisis began to impact daily business activities, the roles of the office of finance and the CFO was changing. While typically regarded as “number crunchers”, the role of the accountant has evolved into a figure who is leaned on for valuable insight that can drive business strategy based on the financial information they present.

Unfortunately, many accountants have found it incredibly difficult to find the time to provide this insight. Due to the amount of manual processing that is required to conduct the close process, the average office of finance was already strapped for time before this new expectation arose. And any analysis, if it is able to be done at all, is completed at the end of the close process.

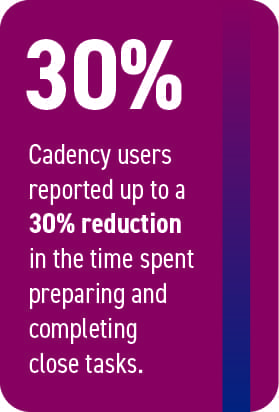

In order to adapt to the changing expectations, organizations have been looking for a solution to empower the productivity of their workforce. Organizations that have implemented Cadency found that there was up to a 30% reduction in the time spent preparing and completing close tasks – leaving plenty of time for the office of finance to transform from “number crunchers” to a guiding force in the company.

Conclusion

As time goes on, all of these trends, demands and goals for the office of finance will only increase. And as they do, more organizations will begin to adopt automation into their office of finance.

Implementing automation throughout your financial processes offers:

- Visibility into areas for process optimization

- Reduction in time spent completing and monitoring close tasks

- Reduction in time to prepare for a close

- Reduction in write-offs

- Risk mitigation

- Identification of bottlenecks in the workflow

To learn about how automation can help you meet the new goals and demands placed on your office of finance, download our white paper.

Written by: Caleb Walter