Delaying Financial Transformation Could Be Costing Your Business

Blog post

Share

It’s no secret that digital transformation initiatives are accelerating in adoption across the globe. In fact, a 2021 McKinsey study found that 66% of businesses are piloting solutions to automate at least one business process. However, back-office functions, such as finance and accounting, have historically been overlooked when it comes to investing in digital transformation projects… until now.

Despite the growing number of enterprises beginning their financial transformation journeys, there are still many organizations that continue to operate with legacy tools and manual processes. One major reason for this is the inherent nature of accountants themselves.

“As accountants, we’re so conditioned to deal with the complexity. We just accept it. And we’re the best agents of change for everybody else, but not for ourselves, and that needs to change.” -Cheryl Levesque, Risk Advisory, DHG

Not only that, but many Offices of Finance choose to delay modernizing their finance processes because they fear the challenges that can come with a finance transformation project, such as the resource cost that these initiatives often require. Managing a financial transformation journey alongside the monthly, quarterly, bi-annual and annual reporting requirements can be a large undertaking for an already busy team.

However, the cost of NOT changing is ultimately greater than the cost change requires.

The Cost of Delaying Finance Process Improvement

When organizations delay financial transformation, there are accompanying opportunity costs that are associated with that decision that leadership teams may not be considering. An example of these opportunity costs are the efficiency gains that are denied both to finance and all the business departments across the entire organization that would benefit from the support that the Office of Finance could be providing if less of their time were spent on manual financial close tasks.

When the business case for financial transformation is examined, the cost of modernizing finance processes must be looked at holistically. That includes looking at the cost the organization is incurring by not modernizing their finance processes.

Let’s explore what organizations risk by delaying finance process improvements.

Increased Risk of Inaccuracy

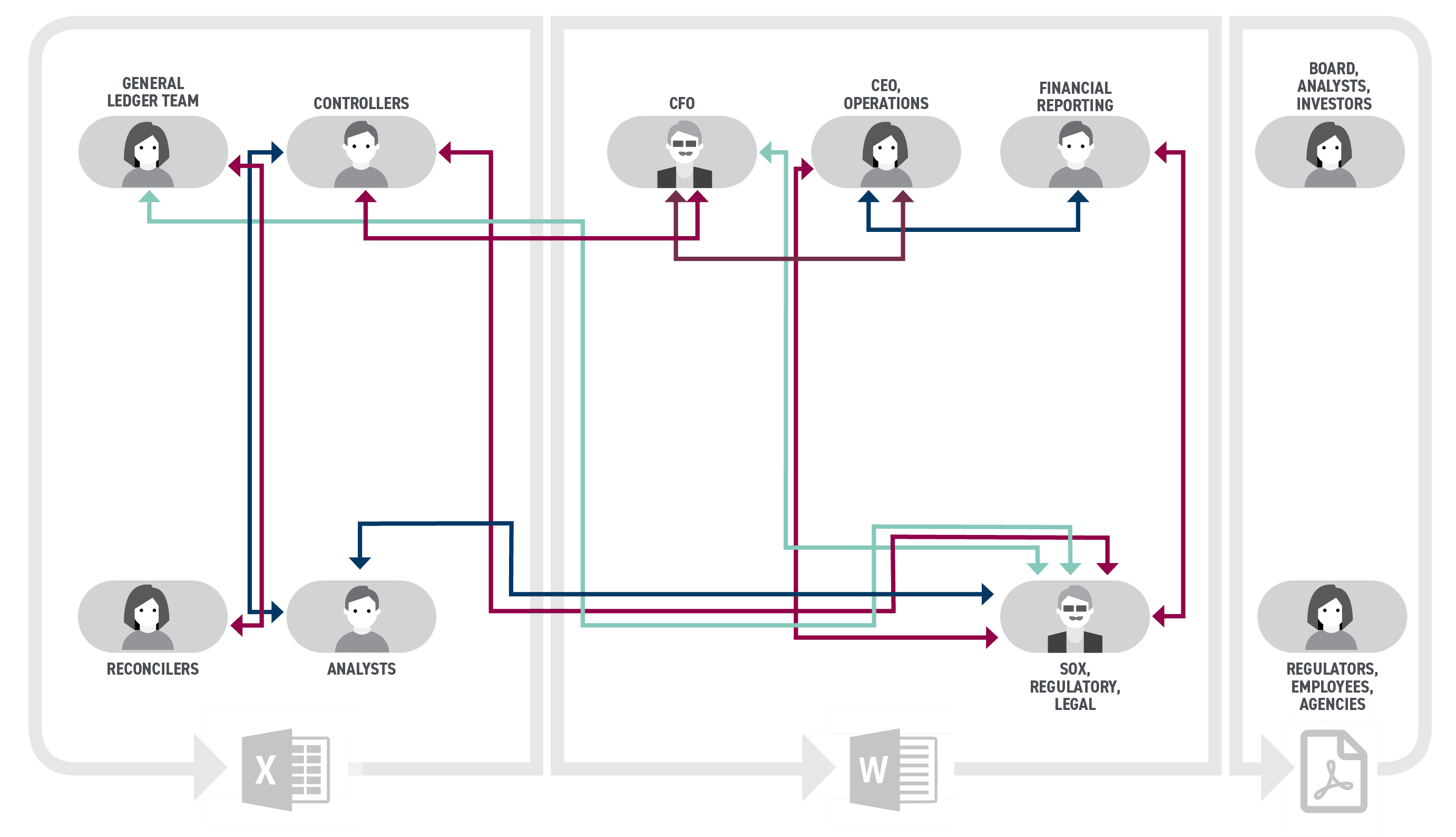

With outdated tools like spreadsheets and manual processes, regulatory, statutory, or reputational risk due to inaccuracy will always be a looming threat for organizations. And sacrifices to meet deadlines, such as trading accuracy for timeliness or losing track of supporting documentation, will continue to happen. Finance leadership might not be aware of the full scope of the problem currently, because they have very limited visibility into the entire Record to Report process, but it will eventually cause noticeable credibility gaps for the organization.

Don’t Lose the Talent War

One of the major disadvantages to the accounting profession is having to sacrifice work-life balance (ex: working long nights and weekends) to meet close deadlines.

Utilizing solutions that offer automation with effective dashboards and workflow ensures the business is set up to support the organization’s workforce wherever they may be located. The past year has changed the work model forever; there is no going back to the status quo of what was before. Whether your company is embracing a fully remote or hybrid environment, the war on talent is heating up and only those companies that leverage technology to advance and move forward will win. This strategy opens up the opportunity to recruit remote, specialized finance personnel while still ensuring the reporting is completed in a timely manner.

As more organizations invest in the processes and technologies their finance teams use, it will be harder to retain top talent if organizations can’t offer a better work-life balance, and provide technology that allows them to move away from manual, tedious tasks to focus their high-level skills and knowledge on strategic initiatives.

Everyone knows people are an organization’s most valuable asset, and the cost of losing top talent and having to onboard new employees is significant.

Inability to Provide Strategic Contributions To the Business

Organizational demands change every day, whether that’s due to external circumstances, such as the pandemic, or internal goals, like a merger or acquisition. However, finance and accounting teams have typically funneled their resources into putting out fires in the organization rather than preventing fires before they happen.

Constantly being in this “reactive” state leaves virtually no time to support the organization through strategy development, revenue optimization, data analytics and more. If finance and accounting doesn’t prioritize finance process improvements and continues to function with inefficient legacy systems and manual processes, they will always struggle to meet the growing demands of the current business environment and will never be able to contribute strategically to drive the organization forward.

Lag Behind Competition

Think about what happens when competitors modernize finance processes to increase organizational value through business agility, data analytics and more, and another business continues to focus only on closing the books with limited time and resources. Over time, a noticeable gap will begin to form, and the organization that hasn’t invested in financial transformation will be left behind in the market.

LKQ Corporation: Executing Over 100 Acquisitions While Remaining Future-Focused

Before LKQ began their financial transformation journey with Trintech, they were challenged with handling their organization’s strategy of rapid growth via aggressive acquisitions. Because LKQ’s finance and accounting teams were still functioning with manual methods, they lacked standardization and visibility and struggled with meeting the demands of their strategic growth.

“We had about 50 to 60 staff accountants all operating as separate business units with separate processes and different financial close schedules. We didn’t have a standardized process to provide us the visibility and insight to feel confident that our balance sheet was correct.” –Accounting Senior II, Financial Systems Support, LKQ Corporation

To keep up with their increasing workload, LKQ chose to modernize their finance processes with Cadency® by Trintech and automate their balance sheet reconciliation, financial close and high-volume matching processes.

LKQ’s Return on Investment with Trintech

Since implementation, LKQ has been able to successfully execute 129 acquisitions and handle their 3,711% revenue growth without adding additional headcount to their Financial Shared Services Center. They standardized their reconciliation and close processes while automating large portions of both.

Today, LKQ manages 21,775 reconciliations within Cadency and utilizes a risk-based approach to drive reconciliation schedules.

The organization has also been able to achieve the following benefits with Trintech’s solutions in place:

- Reduced the close from 9 to 7 business days

- Reduced cash specialist headcount by nearly 50%

- Grew revenues 3,711% and kept Financial Shared Services Center headcount flat

- Loads 100,000+ records and auto-reconciles over 90% of intercompany reconciliations

- Full confidence in timely and accurate information

[cta-content-placement]

Because of LKQ’s investment in financial transformation, the entire organization has benefitted. Finance and accounting can effectively sustain growth goals and execution, pushing them to new heights in their market— while still increasing confidence in the accuracy and timeliness of the reporting. Additionally, their teams have been able to utilize their skills for more meaningful activities like proactively preventing problems across the organization, and they don’t have to sacrifice their personal lives to do that and meet reporting deadlines too.

What would have happened if LKQ had not invested in financial transformation?

If LKQ had not standardized and automated their financial processes, they would have needed to increase their headcount in order to keep up with 129 acquisitions. The acquisition strategy overall could have also been put at risk. On top of all that, their reporting would have been even more complex and difficult than it already was.

LKQ’s risk profile would also significantly increase as they grew because they would still have:

- A lack of standardization and visibility across each accountant’s processes

- No way to glean insights from the data

- No consolidated way to verify if all reconciliations were completed

- No centralized location to store proper documentation (they were previously storing evidence of reviews through spreadsheets and email)

One thing is certain: had LKQ not modernized their finance processes, they would not be as successful in their growth strategy as they currently are due to the momentum that automation created for them.

For organizations today, delaying financial transformation is dangerous to the current and future success of the entire business.

If finance teams continue functioning “the way they always have” with manual processes and siloed legacy systems, the organization will face serious ramifications, including falling behind its market competitors. The full skills and potential of finance and accounting teams need to be unlocked and utilized in order to guide the organization to new levels. The only way to do that is through financial transformation. Don’t delay —the costs in delaying automation far outweigh the cost of beginning the financial transformation journey.

Written by: Ashton Mathai