Your ERP

Enterprise Resource Planning (ERP) systems remain the core of an organization’s daily operation and go a long way to help manage parts of the financial close process. While ERPs serve as an effective means to recording day-to-day transactional data and figures, there is still a significant amount of work that is taken outside of the ERP each period-end which is often managed manually, through excel or other legacy systems, increasing the risk to your financial data.

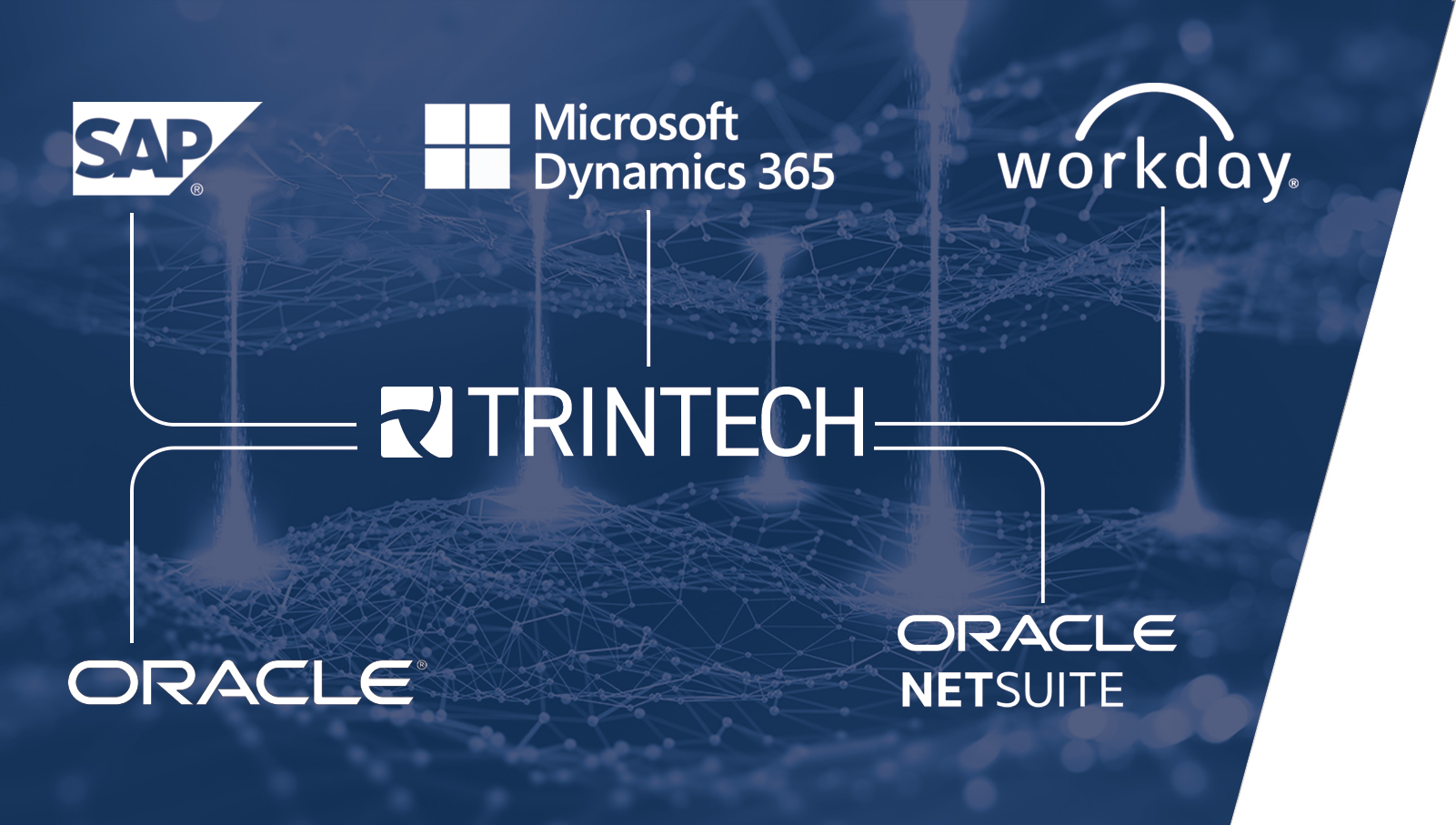

Trintech

Trintech provides financial close solutions alongside your ERP to ensure you can close your books with confidence and adapt to change. With Trintech you can create financial transparency, reduce reporting risk, and gain real-time visibility. Simplify your financial close today!

Overcoming ERP Challenges with Trintech

Some of the familiar challenges accounting and finance teams endure during the month-end close and their ERP system can be overcome with Trintech.

Lack of Standardization

Lack of complex templates and workflows sufficient for your business needs.

How Trintech Helps: Configure templates, create workflows and have the option of localization with easy configuration options with Trintech solutions.

Journal Entry Postings and Approvals

Manual journals require approval, which is difficult with a lack of workflow and documentation within your ERP for postings.

How Trintech Helps: Trintech solutions provide sophisticated Journal Entry capability with permission driven templates, risk ratings and dynamic approval routing.

Balance Sheet Reconciliations

General Ledger/Sub-Ledger recs are eliminated, but that is a low proportion of the whole reconciliation process for month end.

How Trintech Helps: Automate transaction and account balance reconciliations, take a risk-based approach and bulk/auto reconcile accounts.

Legacy Systems

One ERP system is sometimes hard to achieve, and most organizations still have legacy systems and financial data which is outside of the core ERP system.

How Trintech Helps: Control and monitor all month-end activities in one solution.

Manual Tasks

A large amount of manual tasks are still performed within and outside of ERPs at month-end.

How Trintech Helps: Create risk-based automation rules, automate ERP and non-ERP tasks and monitor automations using comprehensive dashboards.

Migrations

Trintech’s financial close solutions utilize automation and seamless integrations for your month-end close processes, while simultaneously ensuring visibility and creating an audit-ready activity record even during your ERP migration.

Before

The financial close process must be standardized first to allow the migration to a new ERP instance. Consequently, implementing a financial close solution is a natural and beneficial part of this process, as it provides companies with a tool to standardize and implement more streamlined processes for their financial close.

With Trintech solutions your business can make sure it has standardized templates for reconciliations and a clear journal entry approval process. The technology supports adoption of these templates across the business, resulting in standardized processes, and clean data for your ERP system.

During

Prepare for a simplified transition with oversight into your financial close activities with seamless integration while you migrate. Drive greater operational efficiencies by automating workflows across your ERP and other enterprise systems.

After

Enhance your financial close activities with a best-in-class system of controls. Use industry standard templates to drive harmonization and use automation to allow for risk prioritization and enhance efforts on value-add activities of your workforce while having flexibility for localization needs and easy configuration options.

Putting Trintech solutions in place will make your migration safer and more transparent, naturally supporting the creation of reliable financial statements and control over the entire financial close process before, during and after the migration.

Integrations and Automations

Trintech has dedicated connectors integrated with our customers’ ERPs, helping automate the information flow and making the period-end financial close much smoother. Real-time movement of data with dashboard visibility makes it possible for teams to post journals in real-time, and extract volume data for reconciliations.

Process automation combined with risk-based capability and AI enables finance teams to focus on high-risk transactions or processes, add value to the finance deliverables and provide insight to help drive continuous improvement. Complete tasks within your ERP system without the need for manual intervention.